The month of September has been marked by stock market corrections, both in Europe and the United States, and by the strong rise in fixed income interest rates. A tougher message from the Federal Reserve, at the last meeting in September, together with the fears caused by a possible US government shutdown due to the notorious debt ceiling limit, caused sales in the main stock market indexes.

In monetary policy, we seem to be in the final phase of interest rate hikes, and the market already has its sights set on the upcoming falls, which are not expected until well into 2024.

Macroeconomics and monetary policy

A divergent growth trend is observed, on the one hand, in the United States and Japan, which they seem to be resisting, and on the other hand, Europe and China are slowing down significantly. It is also observed that in general the deflation process is continuing, but this does not rule out that there may be some upticks in inflation (this was noted in the August data due to the impact of the increase in commodity prices).

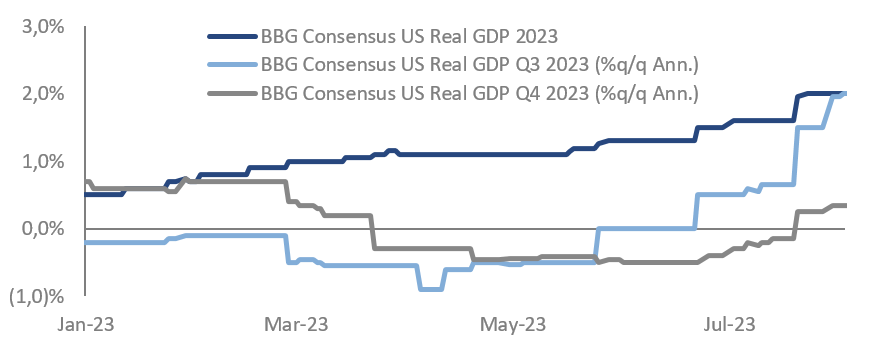

United States: activity data are stable, but are weakening slightly. A deterioration in Consumer Confidence is observed. Advanced indicators suggest weaker growth in the future, even though the rate hike seems to benefit because of the possibility that the American economy can manage to control inflation without going into recession or, in any case, only a very mild recession. No rate cuts are expected this year, and it appears that the labour market is easing gradually.