As we close out September, the main equity indices are practically at yearly lows. The falls have been widespread, also affecting fixed income, which has seen yield curves rise to levels not seen for more than 10 years, especially the short end of the curve. Credit has also widened spreads in both investment grade and high yield. Commodities, meanwhile, continue to fall from the highs reached in June despite the shortages of many of the main commodities.

1. Fixed income is becoming increasingly attractive

Central banks continue to raise interest rates in an attempt to stop inflation. This means that the global economy will suffer from rising financing costs, leading to increasingly plausible fears of a possible recession. Nevertheless, interest rate curves continue to rise, especially at the shorter ends of the curves. Such is the case of the German sovereign debt curve, which has increased by almost 100 bp in September, reaching levels close to 200 bp in its 2-year tranche.

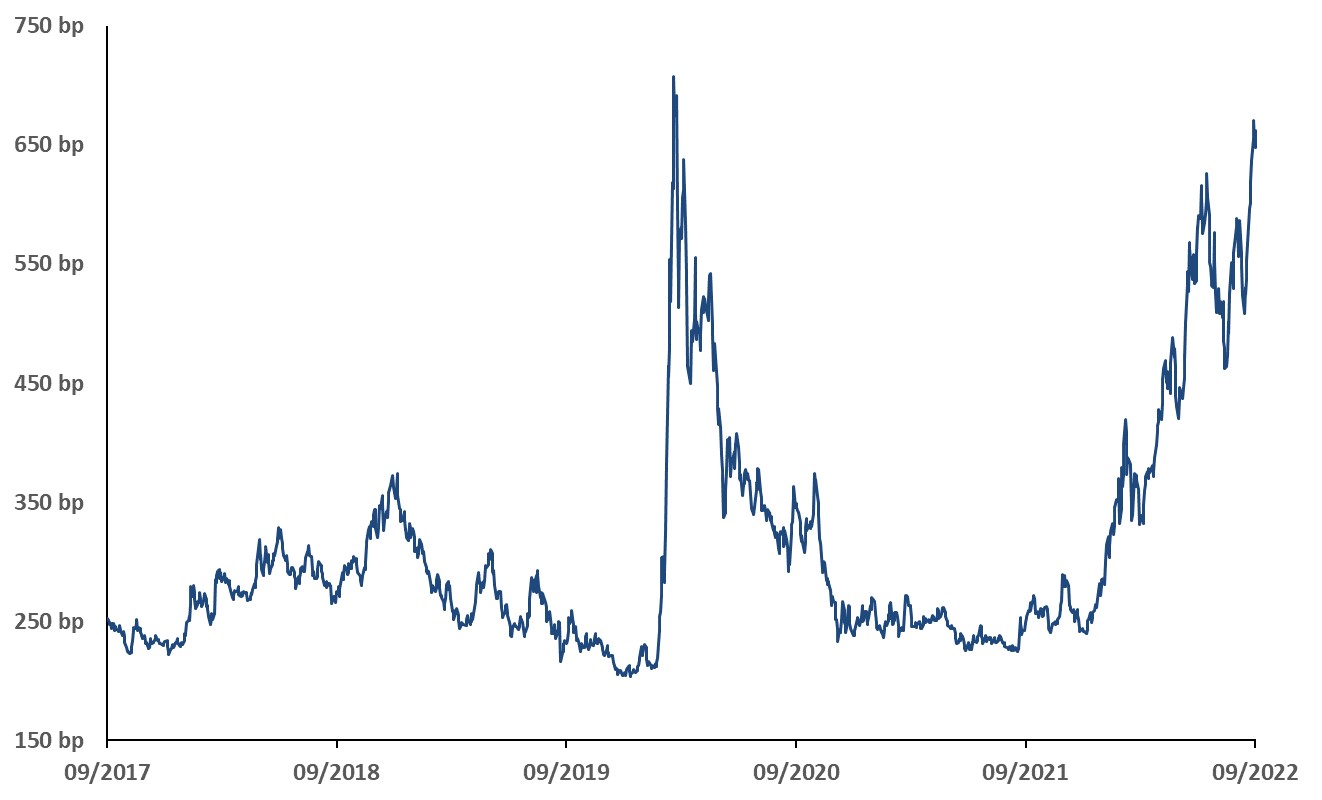

Meanwhile, credit spreads in both Investment Grade and High Yield have widened considerably, causing drops in the price of corporate debt bonds. To return to the example of Europe, the Markit iTraxx European Crossover CDS index has reached yearly highs above 650 bp, levels close to those seen in the 2020 crashes and the 2012 European debt crisis.

At these levels, we do not believe that central banks have much room to raise interest rates much further without pushing the economy into recession. Moreover, with credit spreads wide open, we are starting to see interesting opportunities in fixed income for the medium term, especially in short-to-intermediate duration assets, where IRRs of around 4% can be obtained in Investment Grade and above 8% in High-Yield credit.

Graph 1: Markit Crossover CDS 5Yr index

Source: Bloomberg

Data comprising the period from 29/09/2017 to 29/09/2022

2. Falling commodity prices can be misleading

Following the June highs, commodities have taken a breather and have fallen by an average of 20% in three months. While still posting positive returns for the year (Bloomberg Commodities Index +16% YTD), fears of a recession and the appreciation of the dollar have caused them to fall on the expectation that demand will suffer. Despite this, demand is being sustained by government subsidies. On the other hand, supply can be more accurately estimated and is not expected to improve in the coming semesters due to the lack of investment that has been accumulating for more than 5 years.

In this context, we see that there is still a shortage of some commodities such as oil and coal, which could worsen in the coming months: (1) The possible embargo on Russian oil, (2) the reopening of coal plants, and (3) the use of oil instead of gas to produce electricity in Europe, are some of the arguments that should translate into a positive scenario for commodities.