Inflation remains the dominant global concern, despite the environment of complex geopolitical dynamics such as the military conflict in Ukraine and the territorial tension between China and Taiwan, among many other issues. The evolution of inflation and the central banks’ proportionate response are expected to remain the predominant themes in 2023.

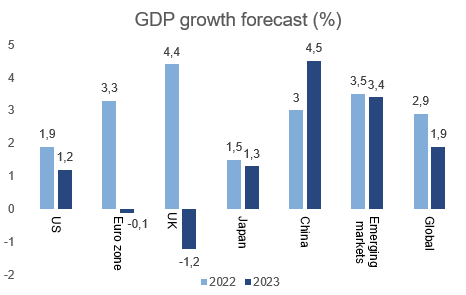

Given the interaction between inflation and monetary policy, many analysts regard the recession as a consequence of the tighter financial conditions. A recession in the United States may be less likely due to its healthy financial system, strong labour demand and robust private sector. The greater sensitivity to external energy supplies makes a recession more likely in the eurozone and the United Kingdom.

The main central banks are expected to prioritise price stability in 2023. The slowdown of growth appears to have occurred, although it’s true to say that expectations vary from area to area. We believe that the energy crisis will inevitably affect Europe to a greater degree. Conversely, growth in the United States may depend more on consumer and business behaviour. Meanwhile, the gradual easing of China’s policies and its gradual re-opening may eventually have a clear impact on its growth prospects.

The global equity markets are likely to have to cope with a degree of volatility until the combination of growth and inflation improves and there are clear changes in the stance of the central banks. In the short term, companies have prioritised protecting their profit margins over income.

As has occurred in 2022, the main trend will be for global yields to move forward in keeping with the policy courses of the central banks, in a scenario in which these courses continue to be dictated by the persistence of growth and inflation. US interest rates are expected to peak in the first half of 2023, but the higher-than-expected inflation may push them higher. Interest rates in the eurozone and the United Kingdom remain linked to the outlook for energy prices and the severity of the recessions.

Global energy prices have declined from the recent peaks, leading us to believe that their contribution to headline inflation may diminish in the future. However, with the price increases linked to the geopolitical context and the somewhat limited inventory levels, the potential risks are skewed to the upside.

Moving across to Asia, the Chinese economy looks set to recover, backed by the further easing of its policies in the coming months. The country is currently witnessing its slowest rate of growth in almost five decades, amid significant stress in the property sector and the dynamics of the zero-Covid policy. The economy is expected to gradually re-open in 2023.

The outlook for the emerging markets in 2023 will be affected by the challenges of slower growth, high inflation, the strong dollar, high US rates and the greater geopolitical risks. At the same time, although the emerging asset valuations have fallen, they aren’t cheap. However, not all the emerging countries are equally vulnerable.

Conclusion: The key question in 2023 is whether the central banks will be able to bring inflation down to more acceptable levels without a recession (or at least without a deep recession). While the pace of the rises in rates is likely to slow in the United States, inflation may mean the Fed will have to keep them high over a longer period of time. We believe that the Bank of England and the ECB are likely to follow suit. The prospects for 2023 therefore come with substantial risks that could generate a volatile environment in the markets.