The shepherd of Gorbea has spoken: “there won’t be even three consecutive days of sun this summer”. When I saw this headline, I decided to take a look into this character, and it turns out the shepherds on this Basque mountain are gurus when it comes to popular meteorology in Spain (correct me if I am wrong). This got me down rather and made me all nostalgic about 2017, not only because it was the second hottest year since 1880 but also because it was idyllic in investment terms: everything went up and there was only good (or excellent) news, such as across-the-board economic growth and tax cuts in the US.

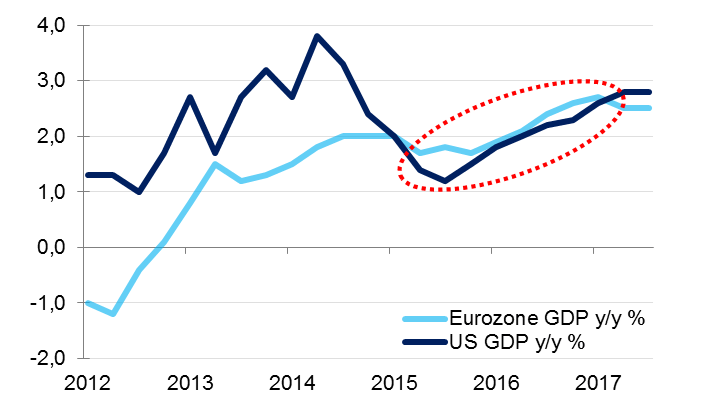

We are half way into 2018 and we have yet to see the summer, like Chris Rea in his song Looking for the Summer, both outside and in the markets. It is true that the climate is not as suitable for extended rallies as last year, when trade war was no more than an urban legend; and now if it is not steel it is China or the G7, cars, NAFTA… At the political level, Europe seemed an oasis of tranquillity, while its economy grew faster than that of the US (chart 1). Today’s figures have fallen back from the levels that suggested GDP growth of 3%, and the recent events in Italy have reminded us of just how fragmented Europe’s political system is.

In 2017, emerging markets generated growth, but never uncertainty, and commodities rose just enough to help manufacturers but without hurting consumers. And because the dollar was in freefall, we stopped looking at deficit and external debt statistics; but a month ago they all of a sudden became relevant again (when the dollar turned). So, it is not surprising that the rally is struggling to continue and that investors have gone back to their old favourite: technology stocks.