MSCI Europe SRI vs MSCI Europe (5 years)

Socially Responsible Investing (SRI) is nothing new, although it has a much longer history in Nordic countries; and in others, such as France, it is gaining importance. One of the main references is the Norwegian sovereign fund, which manages the funds generated by the country’s oil exploration, and it tends to be a trend setter.

There are several ways of setting about SRI. The most intuitive and the first to be used was an exclusionary approach: for example, not investing in tobacco companies, alcohol companies, arms manufacturers, or companies experimenting with animals. Countries were excluded based on human rights records, for example.

But the approach is increasingly thorough, the aim being to follow the best ESG (Environmental, Social And Governance) practices.

In developed markets (both Equity and Fixed Income), there is in-depth coverage by analysts and a growing concern among companies to meet with SRI criteria. However, in emerging countries it is very much a matter pending, and it is the same with small caps. It is a gap that ought to be filled over the next few years, but for now it presents fund managers with fewer options.

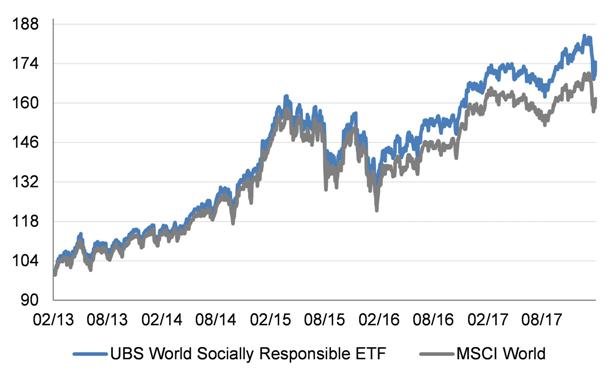

In terms of results, investing in this way does not need to be synonymous with sacrificing returns. There are studies that show how over the long-term companies with high ESG ratings obtain above-average returns, at less volatility. A look at some of the SRI indices corroborates this.