In the month of March the main indices closed positive, consolidating the profits at the turn of the year and highlighting the good performance of Europe: the Euro Stoxx rose almost 4%. On Wall Street the main indexes also rose, although they remained below European returns. The S&P 500 rose around 3% and the Nasdaq 2%. Once again, the evolution of the markets has been marked by central bank interventions, inflation data and geopolitical conflicts. During this month there were two surprises regarding the central banks. The first was the rate hike by the Central Bank of Japan (BoJ), regaining positive ground for the first time in 17 years. And the other was the Central Bank of Switzerland which was surprising as it was the first of the big central banks to cut interest rates by 25 basis points as well as lowering its main policy rate to 1.5%,saying national inflation is likely to stay below 2% for the foreseeable future.

Macroeconomics and monetary policy

The growth in the United States will moderate, but remain healthy. The risk of recession is remote (20-35%) with a soft landing being more likely. Europe will continue to see weak growth even though it’s about to bottom out. The disinflation process will continue, but with some short-term volatility. The key this year will be the flexibility of monetary policy.

United States: Growth in the fourth quarter of 2023 stood at 3.2% year-on-year, but at the same time the growth of the sum of labour supply and productivity growth was around 4.5% year-on-year. This explains why the labour market continued to rebalance and is now roughly where it was in 2018-19.

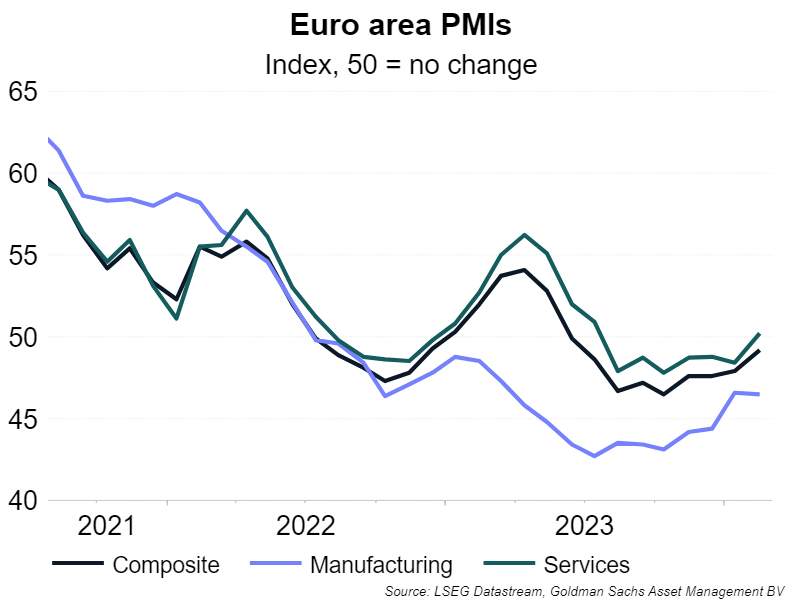

Europe: Signs of improvement (green shoots) are being seen in Europe since the turn of the year, although they are fragile. The PMI has improved, but economic sentiment is still down slightly. However, credit flow is improving slightly, and the real wage growth it is still above the long-term trend against a strong labour market. All this suggests a gradual improvement in growth.