Market Perspectives

The markets have been positive since the turn of the year. The Euro Stoxx 50 in mid-July accumulated more than 10%, after the main European indices closed in "correction" territory in June. The CAC 40, in particular, fell -6.42% in the face of the political instability caused by the call for elections in France following the results of the European elections, in which the political party led by Marine Le Pen, "Rassemblement National", made a strong comeback. The rest of the European indices were also in negative territory. In Spain, the IBEX 35 lost -3.34% and the German DAX -1.42%. Conversely, on the other side of the Atlantic, markets have been accumulating very positive yield since the turn of the year, such as the index of the technology sector, Nasdaq Composite, accumulating almost 25% of returns in mid-July.

Moreover, the European Central Bank (ECB) met expectations in June and lowered the marginal lending rate for the first time since 2016 and the deposit rate since 2019. It lowered all rates by 25 basis points. Chairwoman Christine Lagarde's tone at the subsequent press conference was tougher, making it clear that the rate cut does not imply a change in monetary policy. Subsequent decisions will be made based on the evolution of the data. Additionally, the Eurozone's growth forecast for 2024 was revised downwards to 0.9%. Conversely, they also revised inflation forecasts upwards to 2.5% for 2024 and 2.2% for 2025.

By contrast, the FED kept monetary policy unchanged and left interest rates between 5.25% and 5.5%, with few changes in the statement, but with new interest rate projections pointing to only 1 rate cut this year (vs. 3 previously) but 4 cuts by 2025 (vs. 3 previously).

Macroeconomics and Monetary Policy

The global economy is expected to remain resilient, with positive growth in the US and improving prospects for Europe and Japan. In China, growth is expected to remain subdued despite further stimulus, while momentum in emerging markets excluding China remains positive. Moreover, major central banks look set to ease policy in the second half of the year.

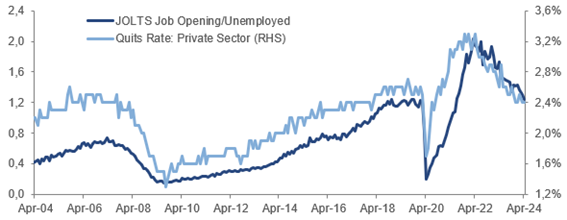

United States: Aided by positive supply shocks, the US economy has achieved a remarkable degree of disinflation and some labour market rebalancing. Demand growth is expected to be moderated by the gradual increase in the savings rate over the medium to long term.

At the monetary policy level, the FED faces a trade-off between its desire to ensure that disinflation has been successfully completed and the risk that a tight policy will be maintained for too long and may provoke a hard landing. Greater confidence in the disinflation process, and more moderate labour market data, opens the possibility of a rate cut that has been shifted in the July-December period (a cut is expected in September). Solid growth supports the view that there is no need to push for rate cuts.

Labour market in the USA

Source: Goldman Sachs Asset Management

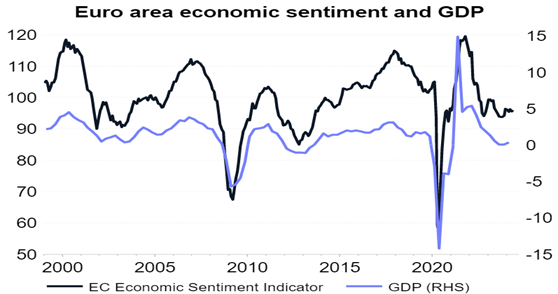

Europe: European signs of improvement (green shoots) are becoming increasingly visible. After almost flat growth for 6 quarters, Eurozone GDP grew by 0.3% in the first quarter and PMI and other surveys suggest that growth momentum will improve further.

Essentially, growth is driven by real wage growth, and for this to lead to stronger consumption it requires the savings rate to stabilise or decline. There is also a slight improvement in new credit flow.

GDP evolution in the Eurozone and indicator of economic sentiment

Source: Goldman Sachs Asset Management