1. Central banks movements

The ECB, which has been by far one of the most reluctant central banks in developed countries to tighten monetary policy, raised interest rates by 50 basis points at its meeting on 21 July, more aggressively than it had initially planned. On the other hand, Lagarde advocated a “meeting-by-meeting” approach to further hikes, increasing her room for manoeuvre according to the evolution of economic data. On the other hand, the approval of the European anti-fragmentation instrument, technically called TPI (Transmission Protection Instrument), was also unveiled. This tool will allow the agency to buy debt from eurozone countries whose risk premium is soaring.

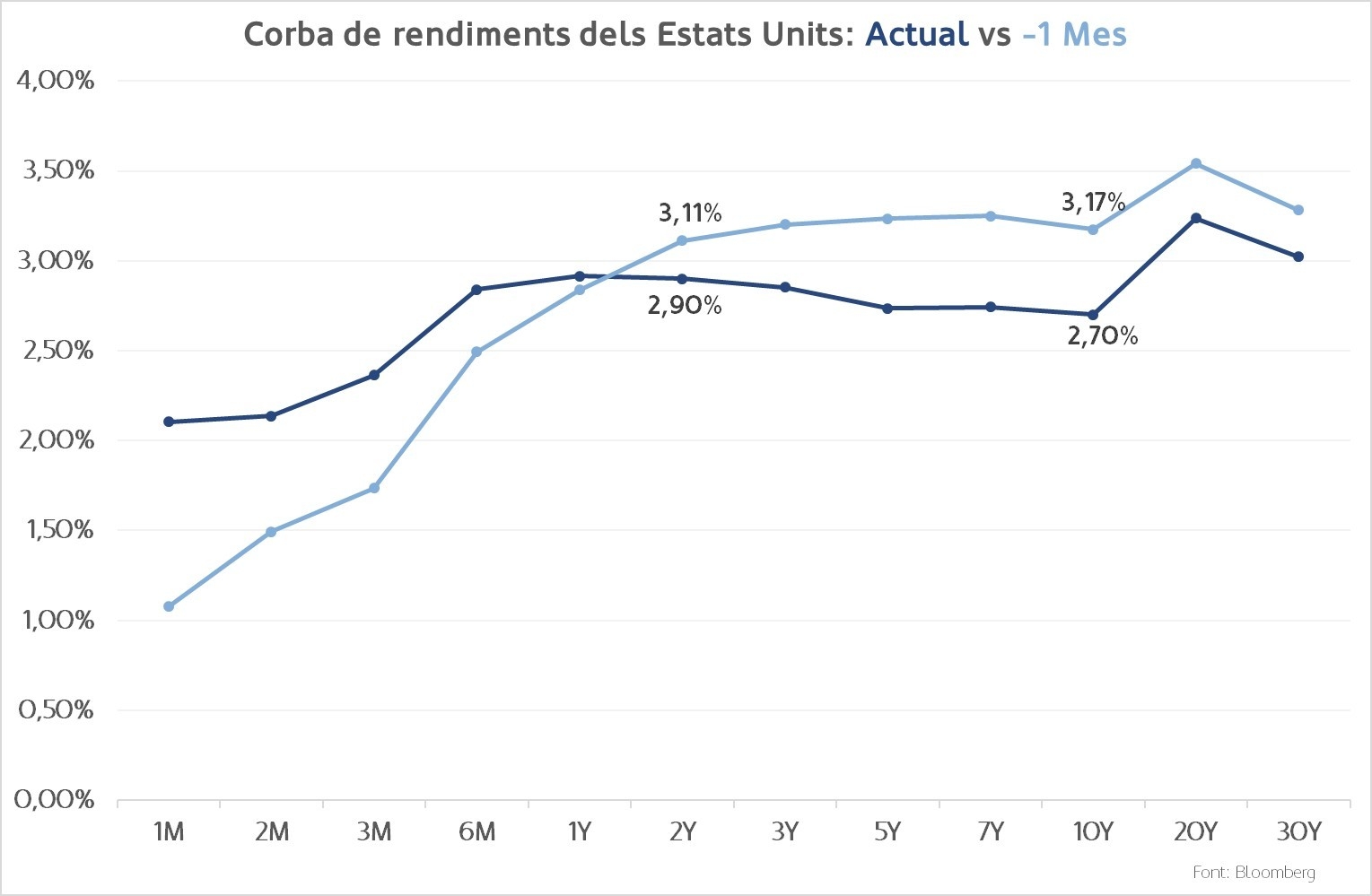

For its part, the FED meeting continued monetary tightening without surprising the market, as the increase in the price of money was set at 75 basis points. The institution set the interest rate at 2.25%-2.50% by unanimous decision, which is considered to be neutral for the US economy. Just as the ECB did, Powell signalled that they will not provide as clear guidance as before, acknowledging greater concern about the apparent slowdown in macroeconomic data.