Behavior of digital banking users

We recently learned about the results of the Cybersecurity and online trust Study in Spanish households conducted by the Ministry of Tourism, Energy and the Digital Agenda of our neighboring country, Spain. Published twice a year, this most recent report analyzed the second half of 2017.

In an increasingly digitalized world, issues like secure internet access, the use of our personal data, and protection against scams and attacks on our devices become essential. The main conclusions of the study are:

- User confidence lost after the global cyberattacks in May 2017 is being recovered through the ransomware called Wannacry.

- The internet is increasingly perceived as a secure place to operate.

- Despite this sense of security, malware continues to pose a threat, in many cases even breaking through the main safeguards (antivirus and firewalls).

- Users take a relaxed approach to security measures and most consider that their devices are “reasonably protected”.

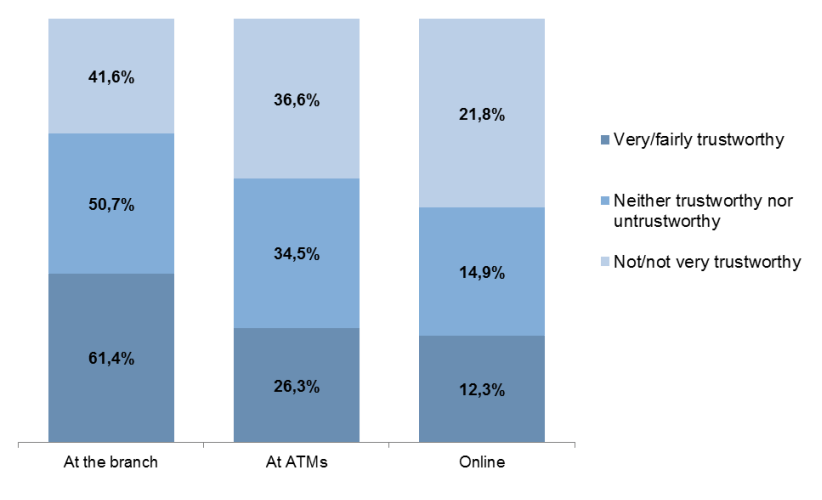

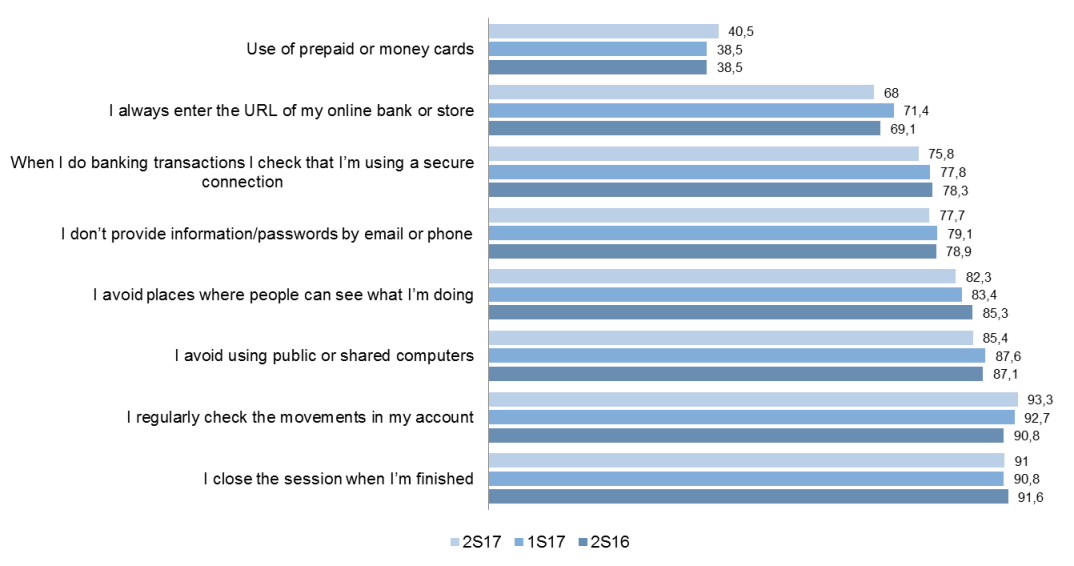

The report also devotes a specific section to analyzing the behavior of digital banking users, showing the evolution of the following criteria over time: