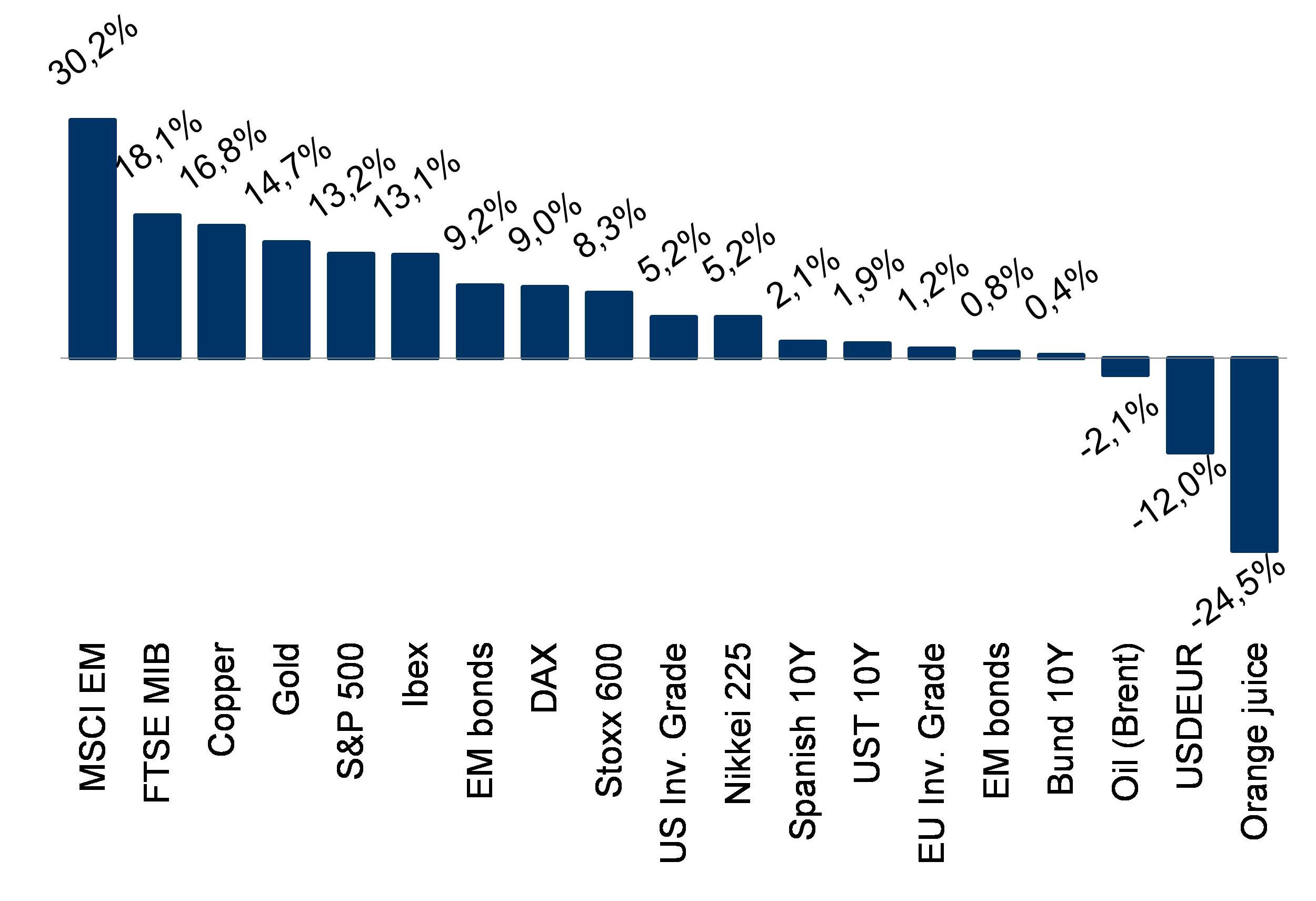

Complacent times: so far in 2017, everything has gone up except for oil, the dollar, and…orange juice!

Winter has been getting close to the Seven Kingdoms for the last seven years, and in the last season, it finally appears to be arriving.

We have been forecasting winter for interest rates for some time; yet, for now these continue to enjoy balmy conditions, like Cersei in King’s Landing: the yield on the bund is no longer negative, but it continues to move comfortably in the 0,20-0,60 range, well below the level I believe it should be trading. And the winners of the last few years seem to still be at the height of summer: credit spreads at all-time lows, and the US IT sector up 25% YTD (compared with the 11% rise in the S&P 500).

As you can see, I am inspired by the seventh season of Game of Thrones. “Winter is coming”, the emblem of the House of Stark, is possibly the best known phrase of the series and means that one needs to be prepared for the worst. In financial markets, I don’t think we are about to see another ice age, but a cold storm, yes!

Those of you who read our June edition of the M&E will know that at MoraBanc Asset Management we made a tactical decision to become far more cautious on risk assets (equities, credit, commodities). It is my view that the current complacent environment, in which virtually all assets are doing well (this year, everything except for the dollar, oil, and orange juice), is unsustainable long term, and good asset allocation will soon be key to generating positive returns. Just as backing the right side in Game of Thrones is vital to surviving.