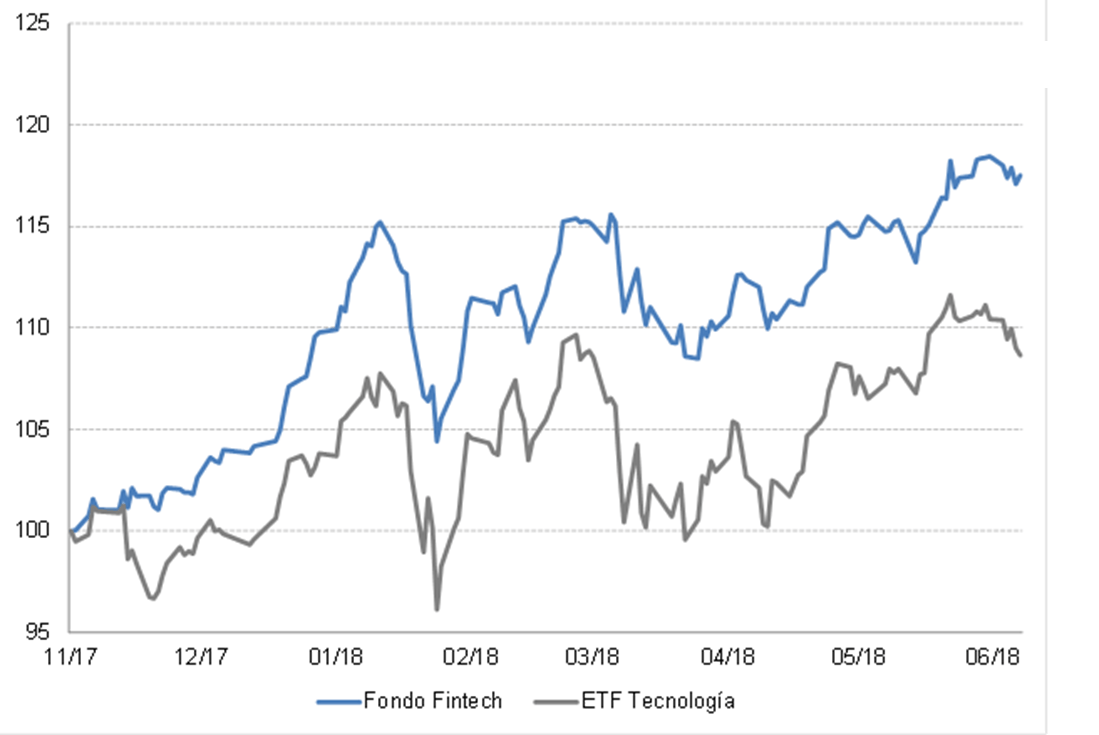

Performance of fintech fund versus Technology ETF since moment of launch (November).

In previous editions, we have spoken about managers’ launches of theme-based funds and ETF. Many of these do have, in principle, their attractions and cover a market necessity. But others are questioned about being merely a trend or a marketing idea.

As with any asset, the detail is vital. Some of the most popular among the recent launches have been those funds linked to technology (robotics, digitalisation of the economy, cybersecurity, etc…). Thanks to the sector’s excellent results, word spreads.

Fintech and artificial intelligence are two of the newcomers. In the case of fintech funds, the idea is to take advantage of the transformation taking place from the traditional to a more digitalised banking model. If we study the portfolio from the perspective of a more traditional sector, we can see how a fintech fund can have a weighting of more than 60% in technology, while in the financial sector the weighting is hardly perceivable. Here we find companies specialising in payment methods, asset management, personal finance, big data; that is to say, a broad spectrum, yet there can still be a good correlation with the technology sector.

As for artificial intelligence (AI), it too is one of the big themes for the future. There are funds managed by models based on machine learning, but this is a subject for another article. The investment theme is to focus on companies developing and implementing AI into their activity. In the future, they are expected to play a big part in the economy; but for time being nearly 80% of the companies investing in AI are technology firms.puede darse

Generally speaking, when it comes to theme funds (and not just in these two examples), it is important to study whether or not the idea is a good one, but also if the timing is right and what the exact exposures and valuations are in the portfolios in which we are investing. A great idea can easily become a bad investor experience if the timing is wrong.