One of Warren Buffett’s best known phrases about markets is “only when the tide goes out do you discover who’s been swimming naked”. It can be applied to most assets, but this year it has been especially relevant to the managers of mixed funds.

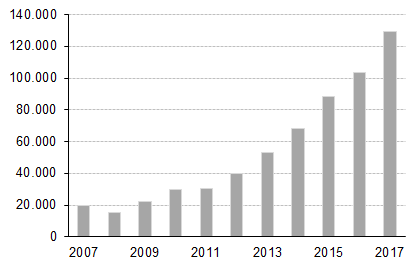

Funds under management in global flexible mixed funds (Morningstar)

In principle, mixed funds is an asset class that gives a wide range of possibilities to its managers, mainly in fixed income and equity although there are some who include currencies as an additional source of return. Over the last 10 years, mixed funds have been one of the leading captors of wealth.

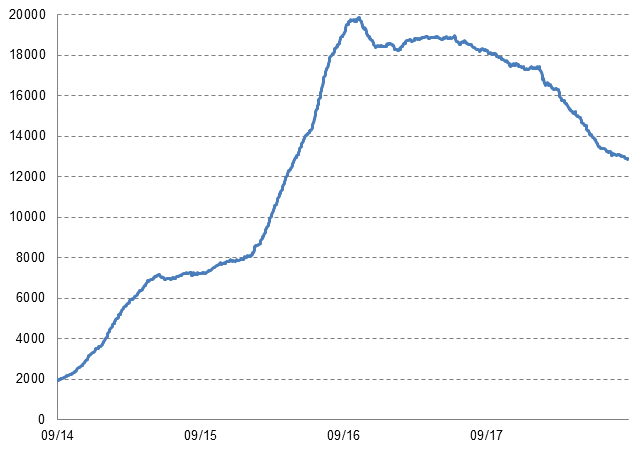

Typical examples include Carmignac-Patrimoine, which, after finishing 2008 in positive territory despite the collapse of markets, saw its assets under management increase; and also Nordea Stable Return, which had to limit new money after reaching €20Bn under management in 2016.

There are numerous sub-categories within the mixed fund category, and these depend on the exposure to equity and the different markets; but for the purpose of this exercise, we have taken flexible mixed funds. And in 2018, the data from Morningstar shows that of the 1,881 funds analysed* just 173 were up on the year.

Obviously, an analysis of managers should be carried out over a longer period, but even so this figure looks disappointing to say the least. This said, it also indicates how difficult the market has become for mixed fund managers, especially for those focused on European markets. If we look at equities, we see red figures across all the bourses, in some case with double-digit losses. And on top, fixed income has not only failed to act as a counterweight but has in many segments actually contributed to the losses.

It is true that many managers have failed to take advantage of the opportunities allowed by their mandates to modify the exposure to equity or to search for opportunities in other sectors or regions, but there are also good managers of mixed funds who ought to be taking advantage of the opportunities provided by the market.

*Categories Flexible Mixed Funds and Global Flexible Mixed Funds, base currency EUR, the most senior fund class as of 12/10/2018

Funds under management in Nordea Stable Return (Bloomberg)

Read our issue of Markets and Strategies to be updated about stock markets. Every month our experts at MoraBanc Asset Management analyze and give their vision of the most important international economic news.