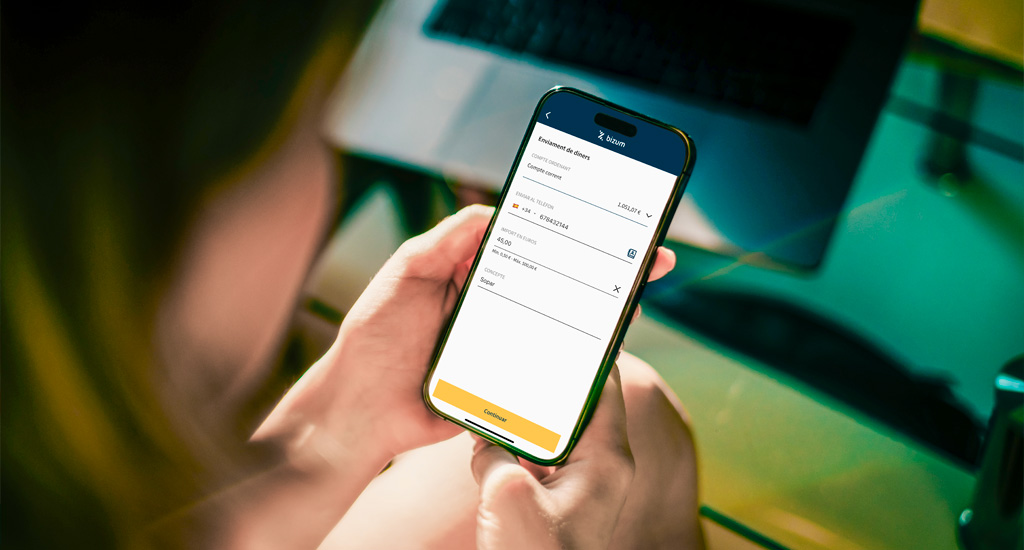

Enjoy the advantages of Bizum

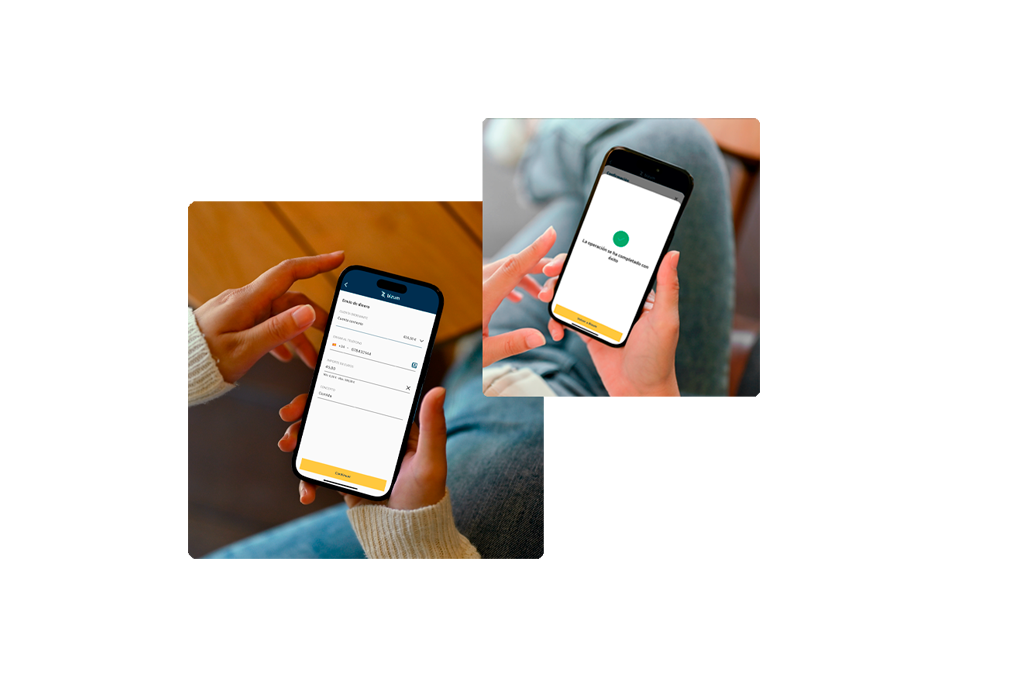

Activating Bizum from the MoraBanc app is very easy.

- Log in to the MoraBanc app.

- Select Bizum from the global position or from My accounts and cards.

- Register for the service by linking the mobile phone number associated with your MoraBanc Digital contract - even if it is not an Andorran number - and the bank account you want to operate with and of which you are the holder*.

- Confirm the process by entering the authorization code you will receive by SMS.

Up to 500 Euros instantly

- The amount of each Bizum transaction cannot exceed €500 or be less than €0.50.

- You can send or receive a maximum amount of up to €2,000 per day and €5,000 per month.

- Each customer can send and receive a maximum of 60 Bizum transfers per month.

You can now pay in online stores

With Bizum, you can pay in online stores that offer Bizum as a payment method. You just need to choose the "Pay with Bizum" option.

Check here for the stores that accept Bizum payments.

Bizum also for minors

Young people aged 12 and over can have Bizum with the MoraBanc app. The minor just needs to be the holder of an account at MoraBanc, and their parent or legal guardian must register them on MoraBanc Digital by linking their mobile phone number to the account.