The European Central Bank seeks to step on the accelerator

Various members of the ECB and its President, Christine Lagarde, have significantly toughened their discourse with regard to the speed of the rise in interest rates planned for this year and designed to combat high inflation, which recorded a year-on-year 7.5% in the euro area on 18 May.

The market is taking the first rise in eight years in July for granted, in keeping with Lagarde’s statements, which would position the rates in positive territory by the end of the third quarter of the year.

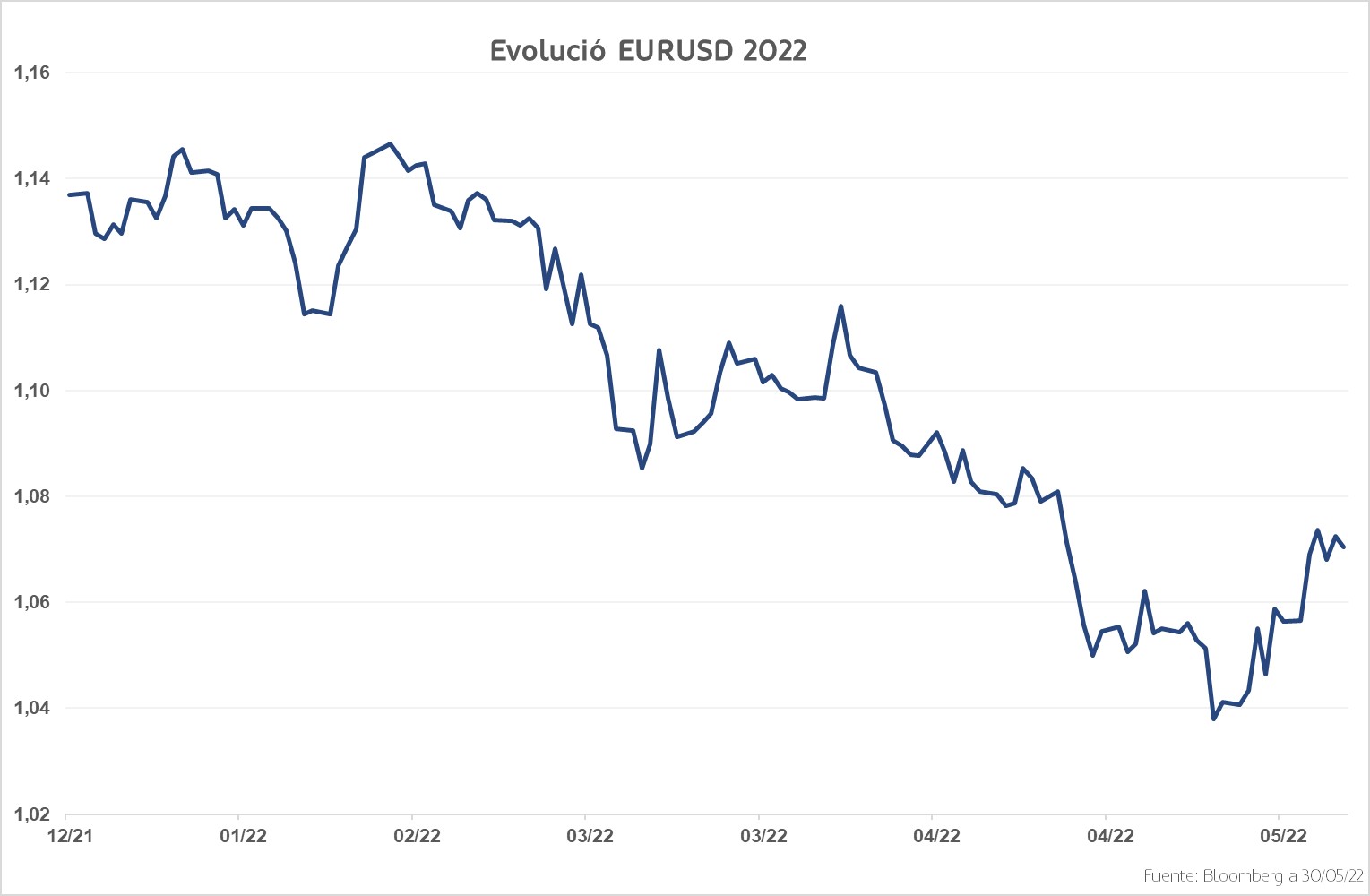

The clearest reflection of this change has been the rapid appreciation of the euro which, after a continuous loss of value against the dollar during 2022, has risen sharply in recent sessions, with an upturn in its price from 1.035 to over 1.07 in just one week.