Last weekend, for the first time this spring, we were able to enjoy some sun. It was the main topic of conversation right across the country: “finally, what a long winter that was!”

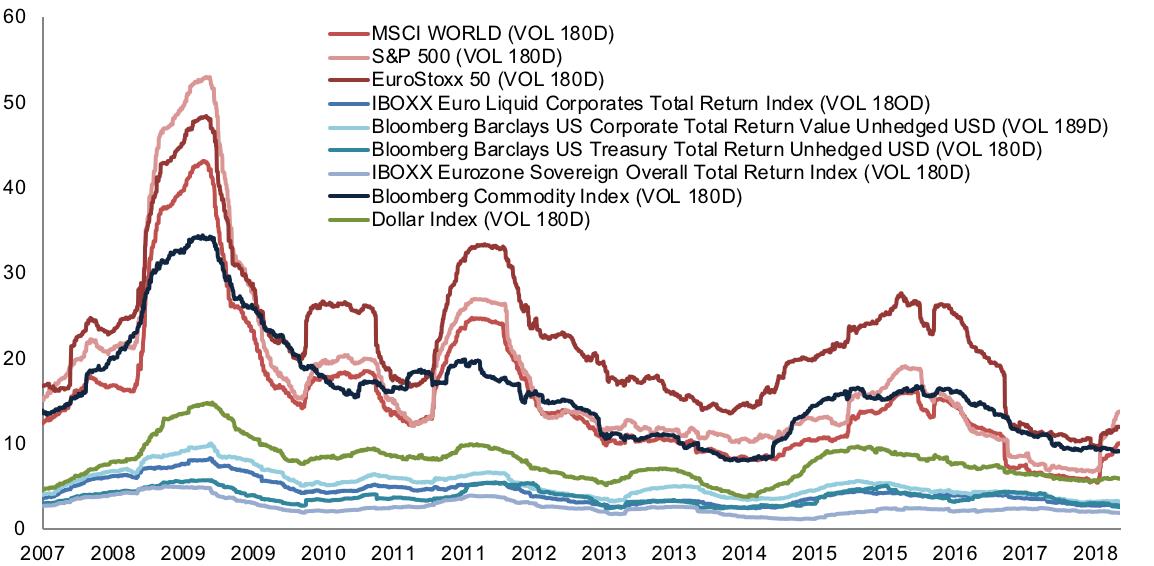

The same has happened to me with volatility (the most widely accepted measurement of market risk). After years during which US markets in particular have shown relative calm and stable returns, the first quarter of 2018 has been accompanied by an increase in implicit risk on several assets, above all equities. Thank goodness! “Why” you be say; because we were witnessing a backdrop of euphoria that ran the risk of triggering serious problems in the future, including in the real economy. A portfolio manager’s work and the proposals they make to clients are based mainly on expected risk and return. Given that risk has been historically low, only those investment houses that understood that such volatility levels were not normal were able to ensure that their clients were correctly advised during the first few months of the year. This warning should serve to ensure that the industry recalibrates its inputs in future, so as to better protect investors’ capital.