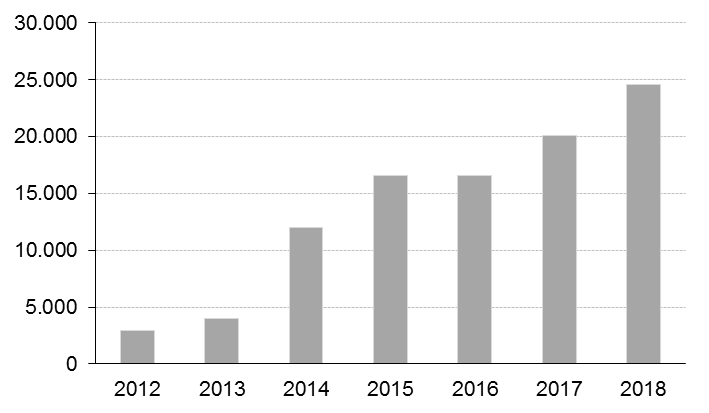

Chart 1. Funds under management: total global funds (in millions of EUR)

In terms of funds under management, mixed funds have enjoyed the fastest growth in recent years in Europe, and in Spain there has been an additional component, with many risk-parity funds falling into the mixed fund category. For example, several asset management companies decided to apply risk-parity approach in their classic mixed funds, such as Carmignac Patrimoine, Nordea Stable Return and DWS Kaldemorgen. In our case, the multi-asset funds are Mora Multi-Asset Tristaina, Mora Multi-Asset Casamanya or Mora Multi-Asset Comapedrosa.

This is one of the most advantageous ways of adapting to MiFID 2 and optimising the client’s portfolio. The first step is to carry out the pertinent tests on objectives and restrictions based on the client’s investments and financial knowledge. And then based on these, the client is given a risk profile (conservative, moderate, aggressive, etc…) which then corresponds to a specific vehicle. This ensures a monitoring and professional management of the portfolio that is consistent with profile’s needs, and the avoidance of products that do not fit the profile (one of the objectives of MiFID 2).