The summer of 2024, beset by volatile markets

2 September de 2024

August has been characterised by uncertainty regarding the future of monetary policy, the US macroeconomic data and equity market fluctuations. The major global stock markets have fallen sharply in the wake of the US macroeconomic data suggesting a potential recession. Unemployment rose in July from 4.1% to 4.3%, a slight increase that reflects a worrying trend. Although the rate remains low, the upward trajectory is creating concerns, particularly due to the fact that job creation also remained below expectations. This led to global fears and triggered a so-called “Black Monday”, in reference to the session on 5th August when the US, European and Asian stock markets underwent stunning downturns. The Japanese stock market was the one most affected, as it fell by 12.40% in just one session, due also to the BoJ raising its interest rates. However, the market rapidly bounced back and, two weeks later, the major indexes such as the S&P 500, Nasdaq, Eurostoxx 50 and Nikkei were performing better than at the turn of the month, thanks to the more positive data relating to economic growth and inflation.

The central banks were yet again the focus of attention, with the market concentrating on potential interest rate cuts by the Federal Reserve (Fed) and the European Central Bank (ECB). So far, the two banks have kept their interest rates unchanged at their monthly meetings, but attention is now focused on the possible cuts in September, motivated by more moderate inflation on both sides of the Atlantic. Moreover, other central banks did make changes to money prices. The Bank of England implemented its first rate cut since 2020, with a reduction totalling 25 basis points. In contrast, the Bank of Japan raised its interest rates by 15 basis points, situating them above 0% for the first time since 2010.

As a result of the fears of a recession in the US, the falls in the main stock market indices and the expectations of rate cuts by the ECB and the Fed, fixed income market prices in the major developed economies rose significantly while yields fell. The performance of the 10-year American treasury bond fell to 3.79%. In Europe, the short tranches also reflected future rate cuts, with the Spanish 2-year bond standing at 2.63% and the German bond at 2.33%.

Macroeconomics and Monetary Policy

Global: Growth in the United States is expected to slow but remain at a healthy level. Further signs of an improvement in the rate of growth can be observed in Europe. China needs a greater stimulus to achieve an economic turnaround. With regard to deflation, it should continue throughout the second half of 2024. Political uncertainty is rising, in view of the presidential election and the outcome of the early French parliamentary elections.

United States: There was less growth in the first half of the year, driven by the slowdown in consumption. The recent weakness of the housing data is leading to downside risks for residential investments. However, the high level of immigration and the more relaxed financial conditions should aid growth in the short term. A soft landing is the baseline scenario, but the risk of a recession remains above average. We expect deflation to continue in the second half of 2024. Besides, we expect the Fed to begin to lower its interest rates in the second half of 2024 (September), thanks to lower inflation and a less strained labour market.

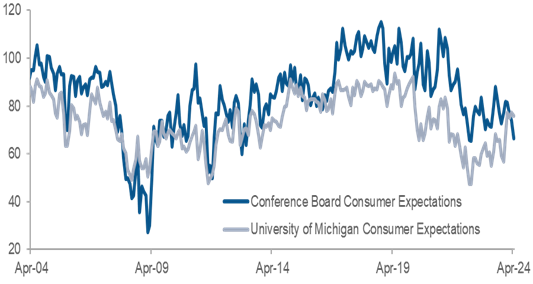

Consumption expectations in the US

Source: Multi Asset Solutions Goldman Sachs, Global Investment Research Goldman Sachs

Europe: Greater growth momentum can be observed. The real income of households will continue to receive support from the stable rise in nominal salaries and declining inflation. Meanwhile, the monetary burden should gradually decrease as the year goes on. This combination is expected to lead to a gradual improvement in growth. However, for this to happen, the labour market will have to remain relatively resilient. As growth picks up and productivity is sustained, the risk of the labour market collapsing will diminish.

As expected, the ECB cut its rates by 25bps in June, providing little guidance on what it will do in the future. We expect the ECB to cut interest rates more than the Fed this year.

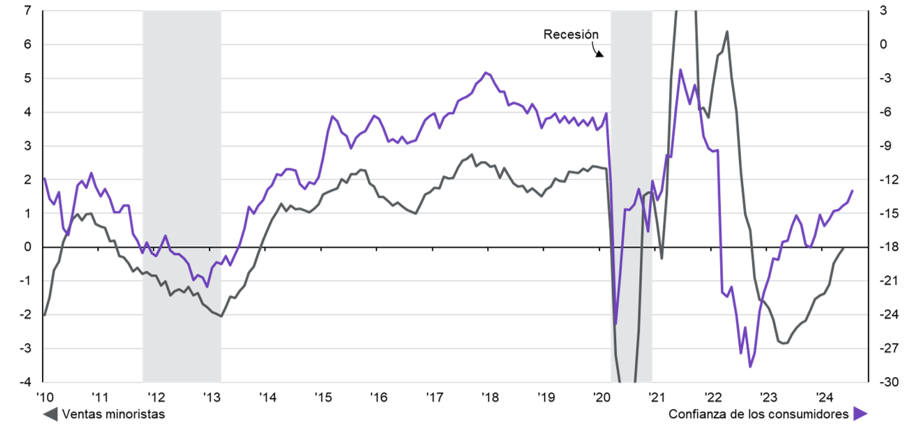

Retail sales and consumer confidence in the eurozone

Source: European Commission, Eurostat, LSEG Datastream, J.P. Morgan Asset Management

Market Perspectives

The equity market remains constant in a resilient environment. Despite the volatility due to the signs of a slowdown in the United States, where disinflation is expected to continue, the expectations of corporate profit growth and the hopes of a looser monetary policy make the outlook for equity positive.

Our positioning regarding equity is neutral, with a preference for small companies, due to their undervaluation, and European equity.

European equity has lagged behind in terms of valuation. An improved combination of growth and inflation, in addition to the change in monetary policy initiated by the ECB anticipating more rapid rate cuts, could lead to a better performance of the markets in the eurozone. Furthermore, the sectoral composition of the European indices (less AI, more consumption) ensures more diversification than the US indices.

With regard to fixed income assets, we retain our positive mid-term outlook, in an environment featuring rate cuts in the second part of the year. The combination of a positive macroeconomic outlook, the central banks easing their monetary policies and tight credit spreads oblige us to remain neutral on credit.

In view of the expected change in monetary policy in the US following the cooling of the labour market, government fixed income has made a move to narrow returns. We believe that this move will continue and we maintain our positive recommendation, with an average duration (3-5 years) for government debt. As for IG Credit, we feel positive in the short term and neutral in the long term. The carry remains attractive for investment grade credit.