Winter is coming?

Finance | 10.02.2017

Winter has been getting close to the Seven Kingdoms for the last seven years, and in the last season, it finally appears to be arriving.

We have been forecasting winter for interest rates for some time; yet, for now these continue to enjoy balmy conditions, like Cersei in King’s Landing: the yield on the bund is no longer negative, but it continues to move comfortably in the 0,20-0,60 range, well below the level I believe it should be trading. And the winners of the last few years seem to still be at the height of summer: credit spreads at all-time lows, and the US IT sector up 25% YTD (compared with the 11% rise in the S&P 500).

As you can see, I am inspired by the seventh season of Game of Thrones. “Winter is coming”, the emblem of the House of Stark, is possibly the best known phrase of the series and means that one needs to be prepared for the worst. In financial markets, I don’t think we are about to see another ice age, but a cold storm, yes!

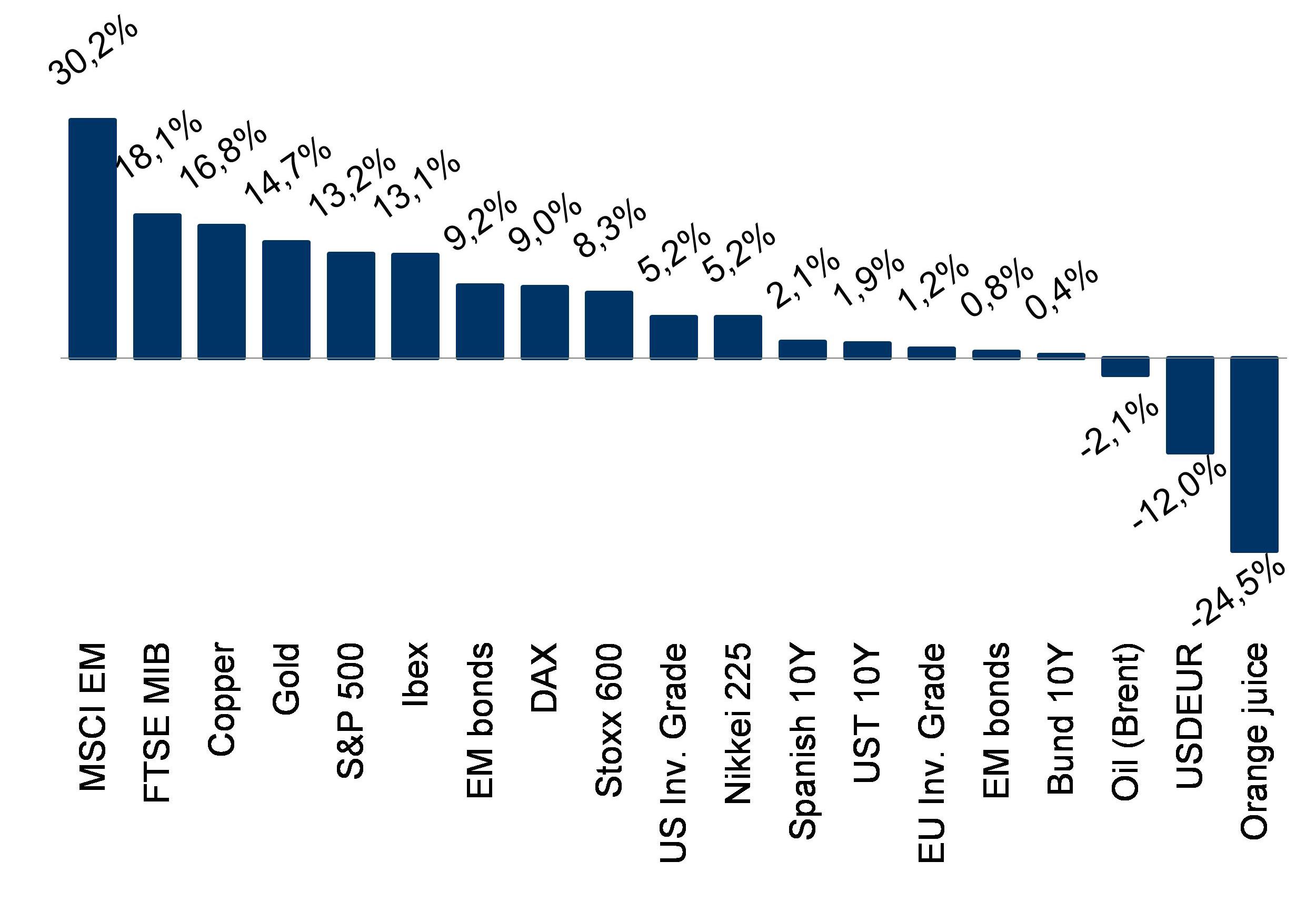

Those of you who read our June edition of the M&E will know that at MoraBanc Asset Management we made a tactical decision to become far more cautious on risk assets (equities, credit, commodities). It is my view that the current complacent environment, in which virtually all assets are doing well (this year, everything except for the dollar, oil, and orange juice), is unsustainable long term, and good asset allocation will soon be key to generating positive returns. Just as backing the right side in Game of Thrones is vital to surviving.

A signal that winter is arriving could be the presence of an increasing number of strange creatures (in the series, fleeing from lands in danger): for example, the cryptocurrencies (bitcoin, ethereum) or the funds shorting the VIX (the so-called fear index, which measures implied volatility on the S&P 500), or the rumoured tapering by the ECB.

The fact that recently virtually every day has brought a new “currency” is, I find, difficult to understand, albeit innocuous in itself; however, I also believe shorting volatility right now is similar to charging (currently 15% per month due to the contango effect) for sitting on a time bomb; a 2-3% drop in the S&P 500 could easily trigger the explosion (sharp jump in the VIX, say 30-40%) and the snowball effect (winter is coming); triggering of stop losses, closing of positions (buying of the VIX), a contagion (the S&P has a negative correlation of -80% with the VIX) and a panic effect, further falls in equities…..And the fact that the ECB is considering ending QE next year is yet another sign that the weather is changing: sovereign debt would lose its biggest ally, and in Game of Thrones this would undoubtedly be bad news.

I don’t believe winter is imminent, because macro data continues to indicate solid expansion, corporate earnings are going strongly and valuations are not extreme. But it has been 14 months since the S&P 500 corrected more than 5%, and the last time the US market went so long without a 5% correction was…22 years ago. So, protecting oneself against the cold and buying back lower down not only seems tempting, but also quite reasonable.

Read our issue of Markets and Strategies to be updated about stock markets. Every month our experts at MoraBanc Asset Management analyze and give their vision of the most important international economic news. Remember that with our Online Broker you can check the share prices of the main stock markets and simulate shares tradings, and our virtual trading account will let you simulate stock trades.

Information on the processing of personal data

In compliance with Law 15/2003 of 18 December on protection of personal data, the customer authorizes that the applicant’s personal data entered on this form will be incorporated into files owned and managed by MORA BANC GRUP, SA – MORA BANC, SAU (hereafter referred to as “MoraBanc”) to process the requested service and, if necessary, to comply with the contracts finally entered into, and also to ensure correct operational procedures.

The applicant expressly authorises MoraBanc to send him/her commercial and promotional communications for products and services and information on the Bank itself, social or other activities, in hardcopy by post or by electronic means (among others, short messages (SMS) to mobile phones, e-mail, etc.). This consent can always be withdrawn, without retroactive effect.

The fact of filling out this form implies that the applicant acknowledges that the information and personal data provided are true, accurate and correct; otherwise, MoraBanc declines all responsibility for the lack of truthfulness or correctness of the data.

The applicant authorises the data provided to be communicated or shared with third parties forming part of the MoraBanc business group, entities which are primarily active in the financial, insurance and service sectors. The applicant is considered as having been informed of this transfer of information by means of this clause. The applicant accepts that he/she may be sent information on any product or service marketed by these companies.

The data processing manager is MoraBanc. The applicant is hereby informed that the rights of access, rectification, suppression or opposition may be exercised in the terms established in current legislation.