MoraBanc and the Mobile World Congress

Experts | 03.10.2017

I was at the last edition of the Mobile World Congress in Barcelona (#MWC2017) to find out about the latest innovations in the worlds of technology and finance, the digital transformation of business and consumer habits.

I would like to tell you about some of the topics that most appealed to me from my visit:

- 5G connectivity and the Internet of things

- Smart vehicles connected to the Internet and cloud computing

- Big data and smart cities

- Artificial intelligence

- Virtual voice assistants

- Chatbots on social messaging networks

- Touchscreens on any surface

I will go on to discuss my vision of potential uses in the banking sector for each of these points.

-

5G connectivity and the Internet of things

5G has been hailed as the future of mobile connectivity with data transmission speeds never seen before (more than 10 gigabytes per second). 5G will affect us in practically everything we use in our daily personal and working lives.

This connectivity will not be deployed in Andorra or Spain in the immediate future. More notably however, this is what mobile brands, telecommunications operators and car manufacturers have been talking about in one way or another on #MWC2017.

It is estimated that by 2020 there will be 50 million devices connected to the Internet (smartphones, cars, domestic appliances, traffic lights, industrial manufacturing platforms, drones and personal robots) thanks to 5G. This is what is called the Internet of things (IoT).

Ideas such as smart homes and smart cities are based on the interconnectivity of daily things through the Internet by promoting the use of communication networks, sensors, cameras and other telematic advances.

From the bank’s point of view, the Internet of things will help us improve customer satisfaction and quality of service by analysing the behaviour of the people who come into our branches and showing them contextualised, customised content in window displays or waiting rooms.

It will also help us to be more energy efficient in our branches and worksites, with the corresponding savings in electricity, heating and air conditioning.

-

Smart vehicles connected to the Internet and cloud computing

Another example of the Internet of things is going to be the connected car. BMW, Ford and Seat were also at the show and they showed us how cars can be transformed by being connected to a smart built-in device that is perfectly in tune with the personal characteristics of each driver.

BMW’s app, Connected Drive, makes it possible to find out traffic conditions or which alternative route to take, as well as the best time to leave home for work or plan for a weekend away.

This app can be managed from your smartphone or smartwatch and even a vehicle’s remote control functions can be enabled. Your phone or watch will become your vehicle’s remote control and will enable you to find your car in the crowded car park of a shopping mall by flashing its lights or sounding its horn, and you could also lock your car remotely if you were not sure that you had done so.

The service is based on a cloud computing solution created by Microsoft Azure that processes data from various sources and displays the information a user may need at any given time.

From a banking point of view, I came away with the idea that we could take advantage of cloud computing, which would enable us to have ample storage space for centralised data and access them from anywhere, with every guarantee of quality service and security.

-

Big data and smart cities

One of the examples that was explained to me at the Accenture Digital stand was the case of CityOS, the city of Barcelona’s operating system.

This system analyses all of the big data from the city’s services to create a single source of information to help Barcelona City Hall anticipate needs and improve citizen helplines.

The aim of this example, illustrated on a hologram, is to make city services more efficient and effective.

– Finding out the traffic flow in congested areas.

– Finding out the levels of air pollution.

– Finding out the levels of noise disturbance.

– Finding out if waste containers are full and monitoring cleaning services.

– Finding out the levels in sewers.

– Etc.

CityOS will also make it easier to take decisions in real time, anticipate emergency situations (torrential rain, etc.) and improve the lives of citizens.

This has involved a large network of sensors and devices throughout the city that make it possible to find out online everything that is happening in Barcelona in real time using state-of-the-art analysis procedures.

From the bank’s point of view, big data also has great potential as it enables us to ascertain our customers’ needs much better, their preferred way of banking, the footfall of customers in our branches, as well as improving queue management at teller windows.

-

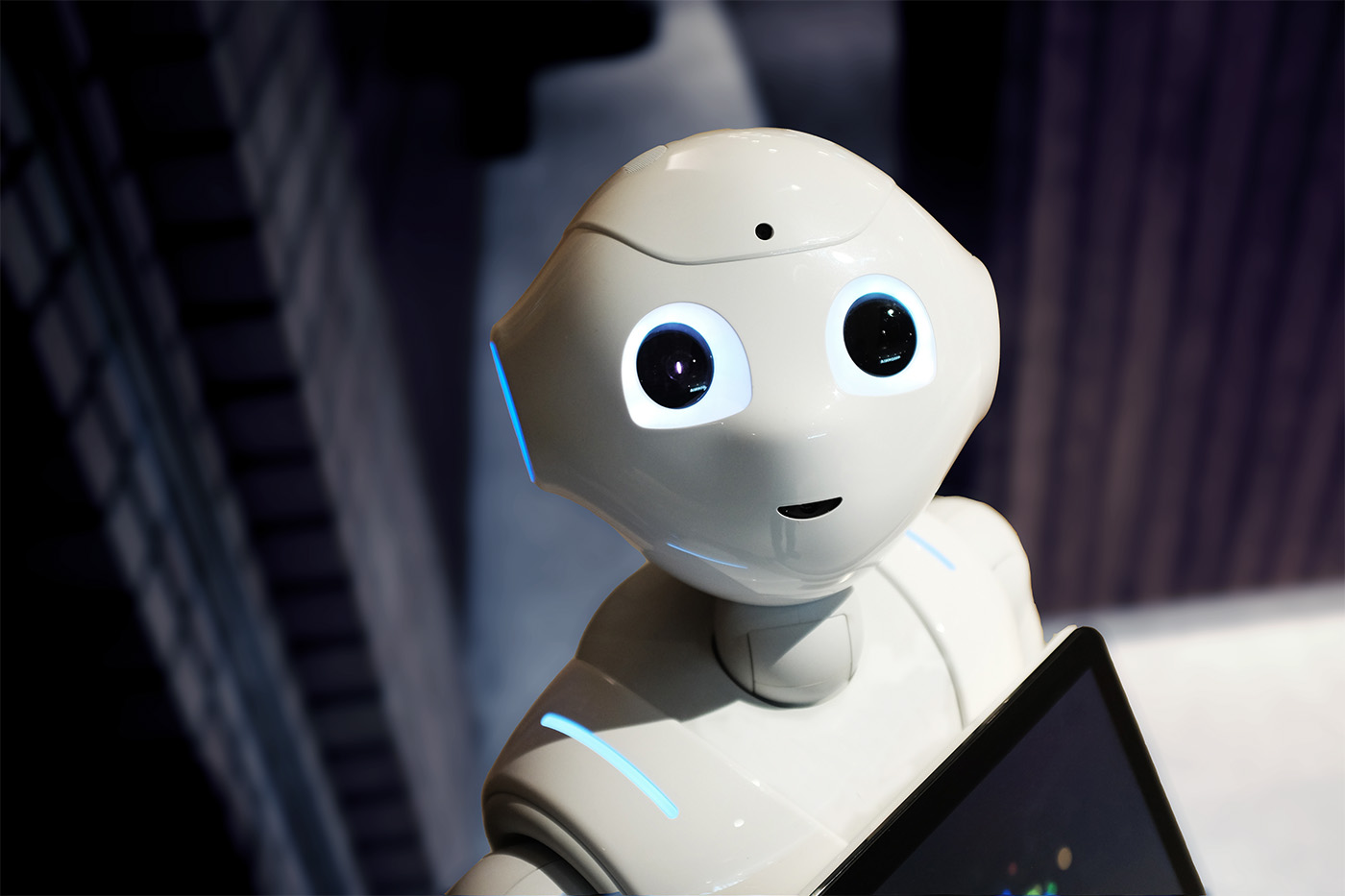

Artificial intelligence

Watson was on display at the IBM stand. It is an artificial intelligence IT system able to understand human language and reply to complex questions by analysing big data, in addition to being able to learn from experiences through machine learning.

The US company wished to explain how artificial intelligence can serve to improve the performance of a sports team or to express how people are feeling as they see a bride’s dress from their messages posted on Twitter.

It had also created a dynamic artistic structure in real time, inspired by Gaudi’s architecture, which used artificial intelligence to interact with the emotions of visitors to social media.

In the world of finance, this system will enable our managers specialised in private banking, foreign trade and telephone banking to access a huge amount of information more quickly and immediately resolve customers’ queries.

-

Virtual voice assistants

I saw a demonstration of Google Assistant, Google’s voice assistant in smart homes. It is in the shape of a loudspeaker to which you can give commands in different languages and get replies about the weather, flight and hotel bookings, etc.

Virtual voice assistants for the home will help you do and remember the shopping list, place your order with a retailer and debit the purchase from your credit card. From this point of view, Google Assistant has put itself in direct competition with Amazon’s voice assistant, Alexa, and other assistants such as Apple’s Siri or Microsoft’s Cortana.

Google’s strategy is to attract more users of smartphones with an Android 6.0 or greater operating system.

In the not so distant future, voice assistants will let us connect securely with the bank online and check the balance of our accounts just by speaking or make a transfer to another bank without having to type anything into a keyboard.

-

Chatbots on social messaging networks

Chatbots or robots for customer services were also to be found at the show. I saw the example of Carla, the online customer bot assistant of Avianca, the Colombian airline, which has put this service under way for users of Facebook Messenger.

The bot is able to respond to the most frequently asked questions about flight routes, flight status, checking in luggage and other questions by recognising natural language via artificial intelligence strategies.

From a financial point of view, in the near future bots will enable us to answer our customers’ most frequent questions 24 hours a day, 365 days of the year, and even conduct simple operations such as blocking a card in the event of theft or loss through a mobile phone’s usual messaging service.

-

Touchscreens on any surface

Sony launched it definitive version of Xperia Projector, now called Xperia Touch.

It is a small projector able to transform any surface into an interactive touchscreen. You can display whatever you want of an office desk, a white wall at home or on a blackboard in a university classroom. It enables you to interact with all applications on Google Play, whether games, social networks or other apps.

According to Sony, the smart device is not limited to showing images, but also responds to you and your touch. It is designed using the latest advances in artificial intelligence, as well as being very easy to use.

The last example illustrates that we will soon be able to access our banking details through any interface or touch device, or make payments through wearables, such as watches and bands.

Digital transformation and MoraBanc

The digital transformation of businesses and society started some time ago and nobody can stop it. That is why MoraBanc has launched MoraBanc Digital, a new concept in banking. A transformation carried out so that we can adapt to our customers’ new habits and become a leader in Andorra in innovation focused on service.

Information on the processing of personal data

In compliance with Law 15/2003 of 18 December on protection of personal data, the customer authorizes that the applicant’s personal data entered on this form will be incorporated into files owned and managed by MORA BANC GRUP, SA – MORA BANC, SAU (hereafter referred to as “MoraBanc”) to process the requested service and, if necessary, to comply with the contracts finally entered into, and also to ensure correct operational procedures.

The applicant expressly authorises MoraBanc to send him/her commercial and promotional communications for products and services and information on the Bank itself, social or other activities, in hardcopy by post or by electronic means (among others, short messages (SMS) to mobile phones, e-mail, etc.). This consent can always be withdrawn, without retroactive effect.

The fact of filling out this form implies that the applicant acknowledges that the information and personal data provided are true, accurate and correct; otherwise, MoraBanc declines all responsibility for the lack of truthfulness or correctness of the data.

The applicant authorises the data provided to be communicated or shared with third parties forming part of the MoraBanc business group, entities which are primarily active in the financial, insurance and service sectors. The applicant is considered as having been informed of this transfer of information by means of this clause. The applicant accepts that he/she may be sent information on any product or service marketed by these companies.

The data processing manager is MoraBanc. The applicant is hereby informed that the rights of access, rectification, suppression or opposition may be exercised in the terms established in current legislation.