Markets on the verge of a nervous breakdown

Andorra Expats | 10.01.2018

This summer, the American vacation rental platform Airbnb launched a really interesting competition, the winner of which stood to win a one-night stay in a look-out tower on the Great Wall of China (including dinner, a concert of traditional music, and a calligraphy class). The contest consisted in writing an essay on the breaking down of cultural barriers.

Well, it was just as well that I found out late because I may well have participated! But Airbnb ended up cancelling the competition a week after announcing it, according to the company, due to the criticism it had received. The competition apparently increased the risk of deterioration of the Chinese monument. Hmmm…the prize was being offered to four winners, each of who got to bring a guest, that is to say 8 people in total; difficult to imagine these 8 posing any significant threat to the Great Wall, which has stood for more than 2,000 years and nowadays draws in some 12 million visitors a year.

Perhaps there was another reason? Well, it seems so: the Chinese authorities said that they had not given Airbnb permission to hold the contest. I automatically concluded that it was pretty logical that Beijing, in response to tariffs, should complicate life for US companies with a presence in the country (or those looking to gain a presence). The case of Airbnb is an amusing and harmless example, but there are many more companies knocking on China’s door; you only need to cast your eye down the list of big names: in the technology sector, Facebook and Google, in payment services, Visa or Mastercard, and then of course those already well established, such as Apple (puts together most of its iPhones in China) or General Motors (which manufactures more cars in China than in the US). What happens if the Asian giant starts to make life difficult for them?

If the conflict were to escalate, I believe the S&P 500, for the time being bolstered by an excellent reporting season, would be far from immune.

Going back to Airbnb, the alternative is that the trade war has me obsessed and that this anecdote has nothing to do with it at all (Airbnb simply got carried away, believing it could convert the Great Wall into a hotel). That it has got me obsessed is certainly possible, because it is the trade war that has (so far) knocked for six our strategy this year! I find it difficult to remember a period of such dichotomy in financial history: an economy in full expansion and markets on the verge of a nervous breakdown, and driven there by just one thing.

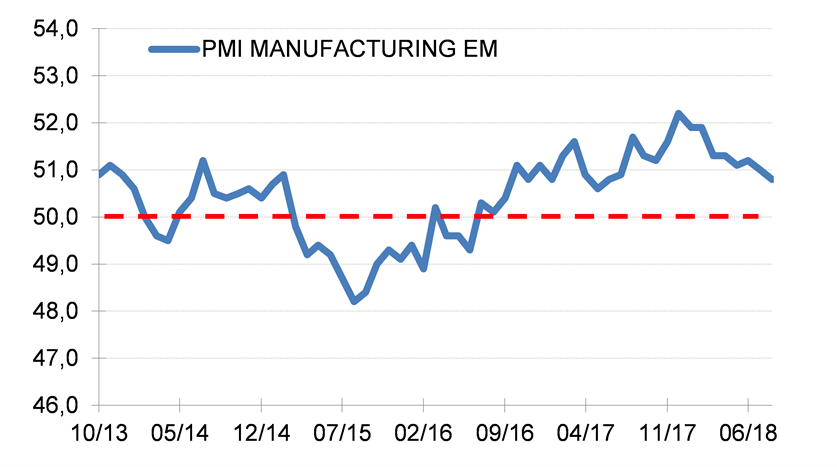

Yet, the fundamentals are still telling us “BUY”. We are sticking with those assets that have been over-punished (Europe, Emerging Markets, credit), rounding these off with some safe-haven exposure (gold, yen). I continue to believe that the trade war could end with an unexpected peace treaty, as happened with the North Korea conflict. The timing? Maybe close to the mid-terms (November 6) we could see Emerging Markets coming back into favour; after all, things have not changed that much since last year when these markets did so well – the PMI has eased back from 52.2 to 50.8, ie 1.4 points. In the opposite scenario (and escalation of trade tensions), we would have to pose ourselves the uncomfortable, but necessary, question: “can the trade war bring an end to the current cycle?”.

Information on the processing of personal data

In compliance with Law 15/2003 of 18 December on protection of personal data, the customer authorizes that the applicant’s personal data entered on this form will be incorporated into files owned and managed by MORA BANC GRUP, SA – MORA BANC, SAU (hereafter referred to as “MoraBanc”) to process the requested service and, if necessary, to comply with the contracts finally entered into, and also to ensure correct operational procedures.

The applicant expressly authorises MoraBanc to send him/her commercial and promotional communications for products and services and information on the Bank itself, social or other activities, in hardcopy by post or by electronic means (among others, short messages (SMS) to mobile phones, e-mail, etc.). This consent can always be withdrawn, without retroactive effect.

The fact of filling out this form implies that the applicant acknowledges that the information and personal data provided are true, accurate and correct; otherwise, MoraBanc declines all responsibility for the lack of truthfulness or correctness of the data.

The applicant authorises the data provided to be communicated or shared with third parties forming part of the MoraBanc business group, entities which are primarily active in the financial, insurance and service sectors. The applicant is considered as having been informed of this transfer of information by means of this clause. The applicant accepts that he/she may be sent information on any product or service marketed by these companies.

The data processing manager is MoraBanc. The applicant is hereby informed that the rights of access, rectification, suppression or opposition may be exercised in the terms established in current legislation.