Investment in family businesses

Andorra Expats | 12.27.2017 | Juan Hernando García

The alignment of interests is often a key objective in the investment world. When it comes to selecting a fund, professionals will often tend towards managers who invest a significant portion of their assets in the funds that they manage or who link their own remuneration to the long-term performance of these funds.

If we extend this approach to company selection, one way of doing this is to invest in family companies. The criteria normally used are that a family group should have a significant stake and that at least one of the family members should hold a senior management position.

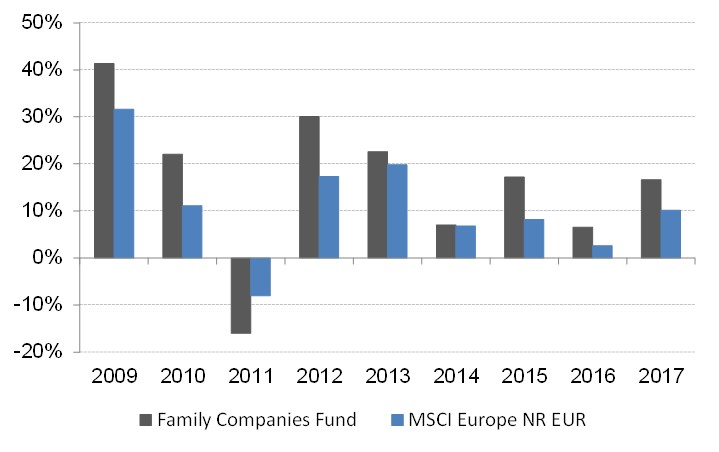

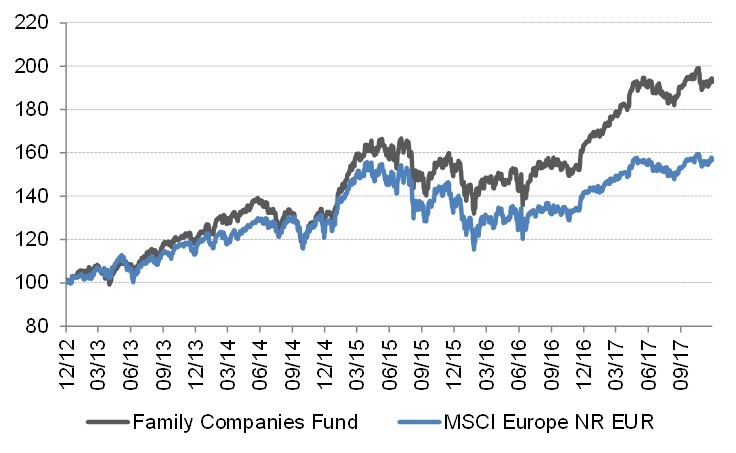

Crédit Suisse published a report (The CS Family 1000) in 2015 in which it demonstrated that family companies had on average outperformed non-family business by 4.5% since 2006.

The investment universe is broader than you might initially expect. And it is by no means limited to small or medium-sized cap’ companies. Names like BMW, Oracle, Samsung and Inditex are all included, for example. Where there are more limitations is in the banking sector, where there are less options.

The Cobas manger, Francisco García Paramés, is a fan of these kinds of companies. In his book, Invirtiendo a largo plazo (Long-term Investing), he claims that 70% of investment is made in family companies, the reason being that “we delegate the control of the management to the families. Who is going to do a better job than the family when it comes to checking that managers are really working towards the interests of the long-term investor”.

The most popular argument used when it comes to valuation is that they tend to be more conservative companies, with low levels of debt, plenty of cash, limited incentives, and strict accounting and a longer-term view. Of course, there are cases like Pescanova and Abengoa, which contradict the theory; but these are very much the exception to the rule.

This article comes from Markets and Strategies, the monthly publication in which our experts at MoraBanc Asset Management analyze and give their vision of the most important international economic news.

Information on the processing of personal data

In compliance with Law 15/2003 of 18 December on protection of personal data, the customer authorizes that the applicant’s personal data entered on this form will be incorporated into files owned and managed by MORA BANC GRUP, SA – MORA BANC, SAU (hereafter referred to as “MoraBanc”) to process the requested service and, if necessary, to comply with the contracts finally entered into, and also to ensure correct operational procedures.

The applicant expressly authorises MoraBanc to send him/her commercial and promotional communications for products and services and information on the Bank itself, social or other activities, in hardcopy by post or by electronic means (among others, short messages (SMS) to mobile phones, e-mail, etc.). This consent can always be withdrawn, without retroactive effect.

The fact of filling out this form implies that the applicant acknowledges that the information and personal data provided are true, accurate and correct; otherwise, MoraBanc declines all responsibility for the lack of truthfulness or correctness of the data.

The applicant authorises the data provided to be communicated or shared with third parties forming part of the MoraBanc business group, entities which are primarily active in the financial, insurance and service sectors. The applicant is considered as having been informed of this transfer of information by means of this clause. The applicant accepts that he/she may be sent information on any product or service marketed by these companies.

The data processing manager is MoraBanc. The applicant is hereby informed that the rights of access, rectification, suppression or opposition may be exercised in the terms established in current legislation.