Market outlook – June 2024

11 June de 2024

In May, the main indices closed in a positive position, breaking the trend of the previous month. The strong recovery of the American indices stood out above all, the Nasdaq technology index rose almost 7%, backed by the good results of the technological giants.

Once again, the markets continued to pay close attention to the evolution of the inflation data, a key issue for central banks’ decision-making. In the Euro zone the latest inflation figure stood at 2.6%, rising more than expected, and moved away from the European Central Bank’s target of 2%. In the United States, inflation moderated slightly compared to the previous month (-1 b.p.) and stood at 3.4%.

In this context, government fixed income continued to rise, as did the 10-year American bond, which traded at levels of 4.63% and closed the month lower at levels of 4.50%. The same trend was seen in Europe, where the 10-year German bond broke 2.70%, being slightly lower at the end of the month.

Macroeconomics and Monetary Policy

Growth in the United States is expected to moderate, but remain healthy. Europe will continue to see weak growth, but is continuing to show signs of bottoming out. The disinflation process will continue, but with some short-term volatility. There is more uncertainty about the easing of monetary policy, in the United States in particular.

United States: GDP in the 1st quarter rose by 1.6%; internal demand has remained strong in the first quarter and inflation accelerated. High immigration rates suggest growth in the aggregate supply of jobs, which should lead to a relaxation in inflationary pressure; on the other hand, demand growth is expected to slow down due to the gradual increase in the average savings rate, which will lead to a moderation of growth. The monetary policy flexibility cycle was slowed by rising inflation in the first quarter and the Fed is expected to start the first rate cut in the second half of 2024.

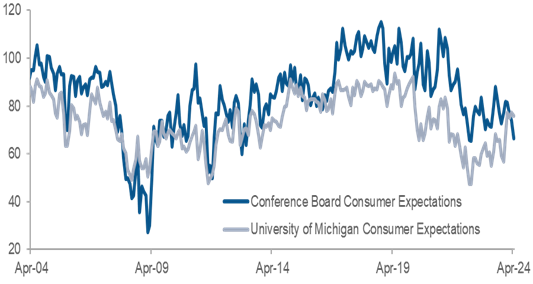

Consumer Expectations in the US

Source: Goldman Sachs Asset Management

Europe: Macro data shows that the signs of improvement (green shoots) in Europe are becoming stronger. In April, the composite PMI rose 1.1 points to 51.4 (expansion zone). Household incomes will continue to be supported by strong growth in nominal wages and lower inflation. This, together with an easing of monetary policy, should lead to a progressive improvement in growth, as long as the labour market holds up.

China: GDP growth in the first quarter was higher than the target official of 5% (5.3%) thanks to the export sector. In the April PMI, manufacturing components were relatively robust, while momentum in services slowed substantially. The main headwinds to short-term growth come from the housing crisis. In the medium term, the main risk to growth comes from the downside business confidence due to state interventionism and regulatory uncertainty. With the Q1 GDP above target, the authorities are in no hurry to add new incentives, which have concentrated on the fiscal side. In this environment, the general CPI is around zero and the risk is more deflationary.

Japan: Japan’s composite PMI hit its highest level since May 2023, after rising to 52.6 points thanks to a rise in both manufacturing and services. Consumption is expected to improve thanks to better growth in real wages. Regarding the core inflation, this remained stable at 2.2% in April, and the BoJ (Bank of Japan) adopted a data dependency approach. Growth is expected to be above potential this year driven by a strong labour market, improved business sentiment and flexible monetary policy.

Unemployment rate in Japan

Source: Goldman Sachs Asset Management

Market Perspectives

As far as the equity market is concerned, the disinflation scenario, the expectation of an interest rate cut (albeit delayed), a soft landing scenario and the acceleration in earnings per share growth amount to a favourable scenario for equities. Profit growth is expected to accelerate further this year and expand outside the Magnificent 7*. In the US there has been a good first quarter results season: 79% of companies exceeded an average of 9.5% in profits. Valuations are high, but mostly focused on large tech companies. The market has weathered the cuts to lower-than-expected rate cut expectations relatively well, as the outlook for earnings growth picks up speed and breadth. Basically, investor sentiment is neutral. Our positioning in equity is neutral, with a preference for small companies due to their undervaluation. Despite the uncertainties surrounding China, the attractive valuations have led to us starting to value it as an attractive area to start investing in.

With respect to fixed income securities, we are sticking with a positive outlook in the medium term, as rates are expected to come down eventually, but the expectation will lag in time and this will lead to near-term volatility, especially if we continue to see spikes in inflation data.

As for credit, in the United States there has been strong demand for corporate bonds by investors, driven by yield. US economic resilience, disinflation and upcoming Fed rate cuts support the asset; however, US credit spreads, both investment grade (GI) and High Yield, are tight relative to historic levels. In Europe, the probability of more benign economic growth outlook in the medium term is growing, the disinflation process should continue (despite the slight uptick in the latest inflation data), and this fact justifies rate cuts this year, which are likely to start in June.

After the spikes in the curves, government fixed income is at attractive entry levels, and for this reason we raise the recommendation from neutral to positive, maintaining an exposure with medium duration (3-5 years).

Even so, there is a risk of a slower rate cut by the Fed and the cost of refinancing will increase as issues issued at low rates mature. The tightening of the rules for granting bank loans and the expected slowdown in growth make us more cautious in the worst quality credit. We remain neutral on IG Credit, despite the historically tight credit spreads. The carry remains attractive as regards the IG.

* Magnificent 7: The companies Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia and Tesla are called “The Magnificent Seven” because of their great performance in the markets.