Balance of the markets in August

11 September de 2023

August was a month for profit-taking on the stock exchanges. The Euro Stoxx 50 fell by 3.90%, the S&P 500 closed with losses totalling 1.77% and the MSCI World dropped by 2.2%.

The markets in developed countries performed slightly better than those in the emerging countries, while the stock exchanges in the United States outperformed those in Europe. The IBEX 35 stood out in Europe by recording the smallest fall (1.41%).

By styles, “growth” stocks in the United States and “value” stocks in Europe fell the least. By sectors, the pharmaceutical sector in Europe led the defensive ones and the energy sector (which had been the one most severely punished during the year) excelled among the cyclical ones.

The advance activity indicators reflected a slowdown on both sides of the Atlantic in August. The PMIs have continued to deteriorate in Europe; the composite PMI stood at 47, below the 50 threshold that anticipates a downturn in economic activity, for the third consecutive month (43.7 for the manufacturing PMI and 48.3 for the services PMI). In the eurozone we should highlight the deterioration of the services sector, which has shored up the region’s activity in recent months. In the United States, the manufacturing ISM remained at around 46 (9 months in a row below 50) and the services sector retreated to 52.7 from the previous figure of 53.9.

The consumer confidence indicators also declined in the two geographical areas; specifically, we should mention the drop in consumer confidence in the United States, significantly affected by expectations.

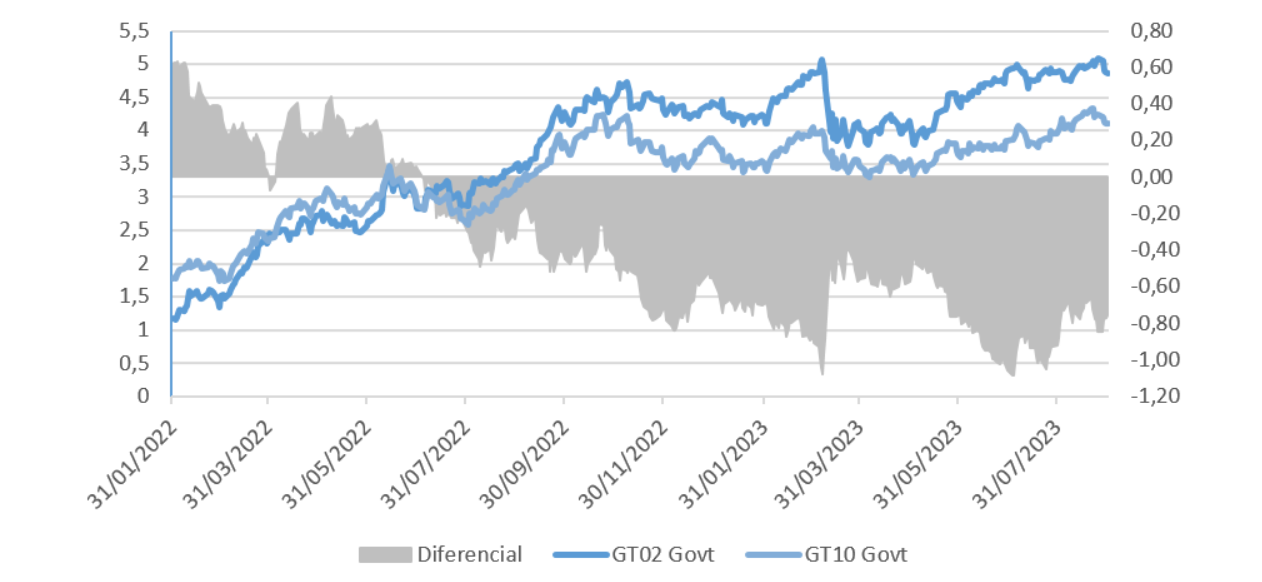

As for fixed income, the rise in yields in mid-August was considerable, with the 10-year American bond recording 4.33% and the 10-year German Bund posting 2.70%, thus affecting the returns of the long-term fixed income strategies. However, at the end of the month, this movement was practically reversed; the North American benchmark stands at 4.11% and the European reference is 2.46%.

2-year and 10-year American bonds

During her speech in Jackson Hole at the Fed’s annual symposium on behalf of the central banks, the President of the European Central Bank, Christine Lagarde, echoed the words of several members of the Federal Reserve, emphasising the need to combat inflation, even if the rises in interest rates had to continue. In her speech, the President insisted on the need to maintain the 2% inflation target, and she has no intention of slowing the monetary tightening before there is some clear progress towards ending inflation. The Fed’s declarations were in the same vein, as it has no wish to rush when it comes to easing its monetary policy.

Inflation in the United States stood at 3.2% in July, compared to 3.0% in June, while core inflation stood at 4.7%, compared to the previous figure of 4.8%. In the eurozone, the consumer price index (CPI) for August remained at the same level as in July (5.3% year-on-year), although it was expected to fall to 5.1%. The rises in inflation in economies such as France, Italy and Spain precluded any reductions.