Market perspectives

11 July de 2023

In June, markets performed very positively, with developed markets performing particularly well. In Europe, June returns ranged from 3.09% monthly for the German DAX index to 8.37% for the Italian FTSE MIB index. In the United States, Wall Street indices exceeded the monthly return of 6%, with the exception of the Dow Jones industrial index. Once again, the technological sector performed well (since the beginning of the year, the Nasdaq has returned 31.73% up to 30 June 2023). The emerging markets, especially in Asia, have clearly lagged behind, even though the performance of the Latin American emerging markets (the MSCI Latin American Emerging Markets Index returned 11% in June) is remarkable.

Macroeconomics and monetary policy

United States: activity data are stable, but are weakening slightly. Meanwhile, leading indicators suggest weaker growth going forward, with some risk of recession, but very low, if at all. In addition, inflation is gradually slowing down. The Federal Reserve is nearing the end of its hiking cycle and is unlikely to cut interest rates this year, given the rigidity of inflation. The labour market is also gradually becoming more stable, although it still remains at too high levels.

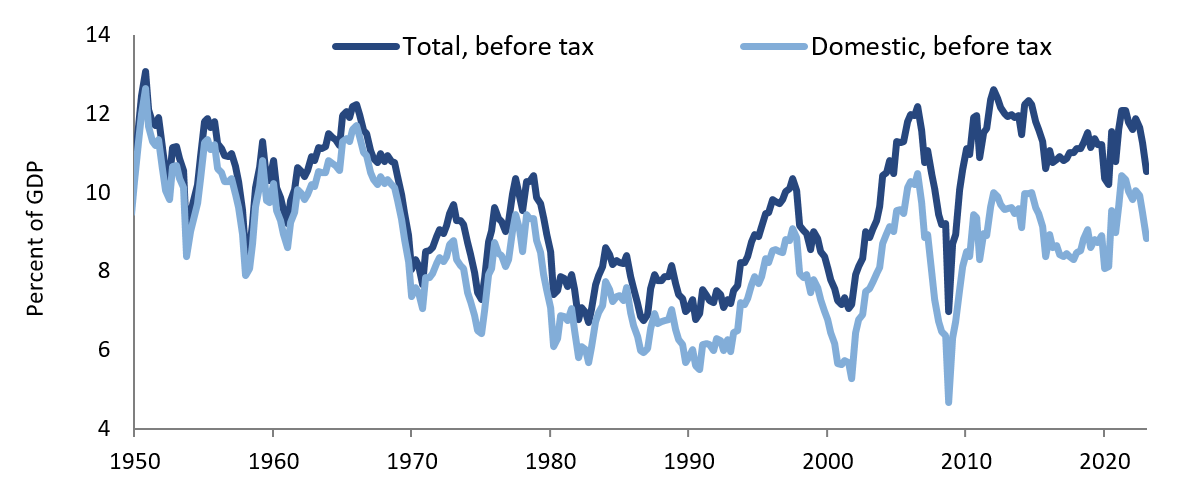

Corporate profits in the United States

Source: Goldman Sachs Asset Management

Europe: is expected to see further economic weakening going forward and there is a risk of recession. If the recession eventually takes place, it will be later and last longer than in the United States. In addition, inflation and interest rate hike cycles are behind US inflation and cycles; the ECB should reach the highest peak of rate hikes in the second half of the year, and then pause thereafter. The Bank of England is under more pressure from rising inflation.

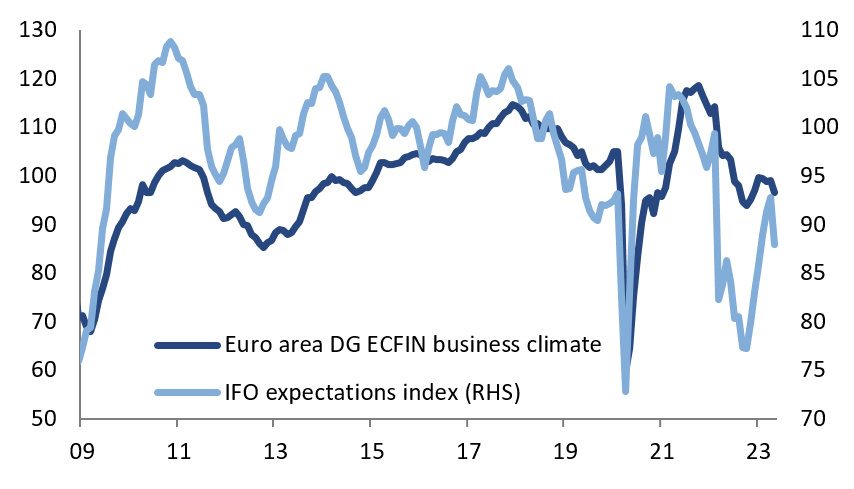

Business confidence in the euro zone falls sharply

Source: Goldman Sachs Asset Management

China: the post-opening recovery is losing momentum, and there is some regulatory uncertainty. There also remains a moderate tendency for the government to ease monetary policy (lowering interest rates) and government stimulus.

Japan: there is strength in domestic demand. The new Bank of Japan governor is, for the time being, keeping the yield curve under control with very low interest rates.

Vision by assets

The markets continue to be positive, anticipating with some optimism the scenario for the end of the year, despite a much more moderate macro outlook, with a risk of recession and a monetary policy close to its highest point in the process of raising interest rates (with central banks warning that they still do not rule out further rate hikes).

As for the US equity market, there are two distinct developments: on the one hand, large-cap technology stocks have been driven higher so far this year by high growth expectations in this sector; on the other hand, other sectors have reacted more conventionally to a tightening of monetary policy and a weaker growth outlook. In this context, the most highly leveraged and cyclical sectors are the most vulnerable to slower growth and tighter credit conditions.

Positive market conditions could still continue in the short term. However, given expectations of weaker growth and a possible weakening of corporate results, and the fact that central banks are still willing to tighten monetary policy to ensure lower inflation, we prefer to maintain a cautious stance on equities.

In this context, and considering the expectation of moderating inflation in the future, we highlight fixed income assets as the most attractive in this scenario. Although both the Fed and the ECB could still raise interest rates one or two more times, we are reaching the final phase and the next important move will be a rate cut, which, although the timing is uncertain, we do not expect before next year.

The scenario of a possible mild recession in the US makes us more cautious on US low-quality credit, considering that current spreads are tighter than those seen in times of recession.