Market perspectives

7 June de 2023

After quite volatile markets during the month of May, due to the release of weaker macroeconomic data and negotiations in the United States to raise the debt ceiling (which was finally approved), the Euro Stoxx 50 fell during the month of May by -3.24% (from April 28 to May 31 2023), whereas the S&P 500, on the other hand, rose slightly by 0.25% during the same period. For its part, the Nasdaq, the American technology index, stands out with a monthly rise of 5.80%.

Macroeconomics and monetary policy

Weak growth is expected in the United States, with a high risk of a slight recession as a result of the restrictive monetary policy in effect and some strict credit standards, that weigh on economic activity.

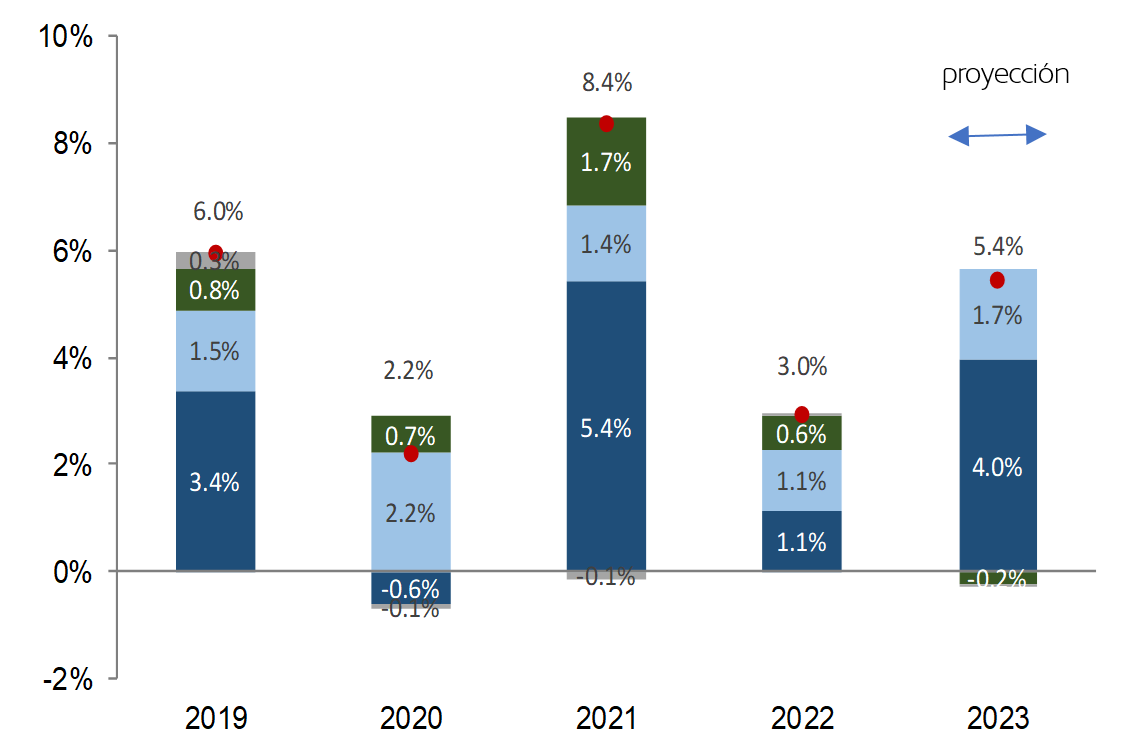

In the Eurozone growth is also expected to be weaker, with a high risk of mild recession. Germany, the main economy of the eurozone, has already entered a technical recession after recording two consecutive negative quarters (GDP contracted by -0.3% between January and March). The German economy has been affected by rising prices, which have affected consumption. Global growth should benefit from improved growth in China forecast of 5.5%-6% in 2023, and it would benefit from the reopening and support policy.

Inflation is expected to moderate but it will still be relatively high in the short term, especially in Europe and the United Kingdom. In the United States, inflation is expected to moderate in 2023, but short-term risks of high inflation remain, given the strength of basic services and a certain upturn in the prices of second-hand cars.

In the field of monetary policy, the U.S. Federal Reserve is expected to pause its interest rate rises, but no cuts are expected for this 2023, unlike the market, which expects some drop. In the Eurozone, the European Central Bank is expected to continue raising interest rates to 3.75% before pausing.

Update on China

With China’s departure from its zero-COVID policy, consumption is expected to lead the recovery of economic activity in 2023.

A modest upturn in underlying inflation to 1.1% this year is also expected, as wage pressures remain moderate and companies appear willing to set higher prices.

On the other hand, the negative impact of the housing market on growth should decrease gradually.

The risks to the economic outlook have become more balanced thanks to a faster recovery from COVID and signs of stabilization in the property sector.

The main uncertainties that weigh on expectations are the willingness of Chinese consumers to spend their surplus savings and the still uncertain outlook for the property sector. The fact that there is an intensification of geopolitical risks could weigh on investment.

GDP growth projections (% annualised)

Source: Goldman Sachs Asset Management

Equity

After a start of the year positive for the stock markets, on both sides of the Atlantic, with the support of strong macro data, with better than expected first-quarter company results, and already entering the last phase of a restrictive monetary policy, the risk assets now face many uncertainties, as real GDP decelerates and valuations are high, especially in the United States.

Taking into account expectations of weaker growth and a possible weakening of business results, we prefer to maintain a positioning of caution in equities.

Fixed return

The fixed income remains attractive, especially coming to the end of the cycle of interest rate hikes and due to better inflation data in Europe.

In the short term, the macroeconomic data remain resilient and inflation remains relatively high, but clearly on the path to moderation. The market is still pricing in US interest rate cuts in the second half of 2023, albeit increasingly less so, and we don’t think they will occur this year.

We maintain a positive bias regarding duration strategies in the United States and Europe heading into the end of the year, as the end of the interest rate hike cycle approaches and after more optimistic inflation readings across Europe.