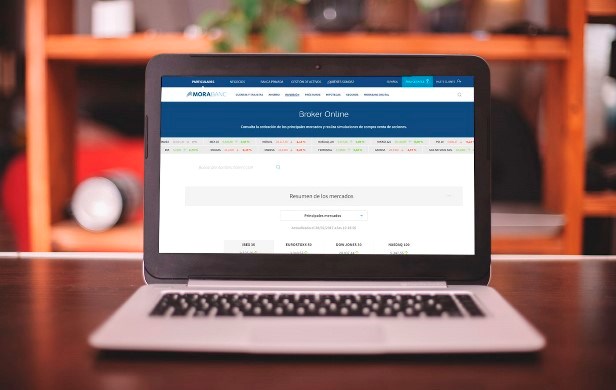

Private Banking Exchange Online

Easily invest in equities and fixed income

If you want to invest your savings in the stock market, you will find the most convenient way to do so at MoraBanc.

-

Fixed-income and equity products

You can easily buy and sell securities, both fixed-income and equities, on the main global stock markets with real-time quotes.

-

Information on international stock markets

Access all the information on international stock markets completely free of charge.

-

Directly from Online Banking

You can access stock market prices, indexes and securities, as well as analysis tools and the latest news free of charge.

Features

- Perform transactions with Online Broker through your securities account – which is pre-opened for all MoraBanc customers.

- You will be able to invest in the main global stock markets 100% online.

- It is also possible to perform transactions through phone banking and in branch.

- Free and customisable access to market information in real time.

-

Securities portfolio management and access to support tools.

Check all the conditions

Information about investment in SHARES:

Shares represent a proportional part of the share capital of a public limited company; accordingly, they grant their holders the status of owner shareholder of the same, in proportion to the size of their shareholding. This shareholder status involves both a series of rights and a series of responsibilities linked to exercising them. The shares make up the company’s capital. The list price of a share at any given time will depend on the market valuation of the issuing company. This valuation is subject to a number of factors and circumstances which means that the shares may fluctuate upwards or downwards significantly.

Warning about the risks related to investing in SHARES:

Shares are variable income securities so the outcome of your investment is unknown. Both the price at which the shares can be sold and the dividends to be received during the period of ownership are uncertain. Investments in shares are characterized by their uncertainty in terms of the result of the investment. Accordingly, they put your capital at risk. An investment in shares may carry the risk of a total or partial loss of the investment.

Other warnings:

The fact that the Bank may provide information about the situation, performance, evaluation and other aspects of the markets can never be taken as a commitment or guarantee of action, just as it cannot assume any responsibility for the performance of the investment or disinvestment. Highly concentrated investment in variable income is not recommended since it is not a complete investment programme.

Information about investments in INVESTMENT FUNDS:

Investment funds are collective investment schemes; this means that individual results depend on the performances obtained by a group of investors. The management company invests the money provided by investors (participants) in different financial assets (fixed income, variable income, derivatives, bank deposits, etc. depending on the investment policy of the fund), which make up the assets of the fund. The performance of these assets in the markets will determine the positive or negative results that will be assigned to the participants in proportion to the total fund assets that their investment represents. Investment funds are open schemes, in other words, any investor can enter or leave the fund by buying or selling units. These transactions will be carried out according to the terms set out in the information brochure and/or the fund regulations. The investor pays certain commissions which vary from fund to fund. Management and depository commissions are charged to the fund, and so they are deducted from the profits obtained by the investor. Furthermore, there may also be commissions for purchases and/or reimbursements, which will increase the payment that has to be made and/or reduce the amount to be received upon sale.

Warning about the risks related to investing in INVESTMENT FUNDS:

Like any other investment product, funds carry certain risks. If the markets in which the fund is invested do not perform as expected, there may be losses. The nature and scope of the risks will depend on the type of fund, its individual characteristics and the assets in which it invests its capital

Other warnings:

The fact that a fund has performed well in the past, does not guarantee that this level of performance will be maintained in the future. The fact that the Bank may provide information about the situation, performance, evaluation and other aspects of the markets can never be taken as a commitment or guarantee of action, just as it cannot assume any responsibility for the performance of the investment or disinvestment. Highly concentrated investment in a single type of fund is not recommended since it is not a complete investment programme.

Test your tradings in the stock market virtually

With our virtual trading account, completely free of charge and available to both clients and non-clients, you can simulate trades without any risk. In this way you can test your operations beforehand and assess their viability. And in addition to this, with the virtual trading account will also give you access to advanced tools including e-mail notifications, personalised information and access to stock search services.

Create your MoraBanc virtual trading account in just 2 steps and start experimenting with stock trading.

If you already have a virtual trading account, log in here.

Your securities account gives you more

MoraBanc Investment funds

Online and independent subscription or reimbursement of MoraBanc’s investment funds.

Wide range of investment products

Thanks to your personal account manager , you will be able to trade in:

- Debentures and bonds.

- Investment funds from other leading management entities.

- Structured products.

- Futures and options over currency and structured indexes.

- Currency.

Apply

Write to us and we will contact

Information on the processing of personal data

In compliance with Law 15/2003 of 18 December on protection of personal data, the customer authorizes that the applicant’s personal data entered on this form will be incorporated into files owned and managed by MORA BANC GRUP, SA – MORA BANC, SAU (hereafter referred to as “MoraBanc”) to process the requested service and, if necessary, to comply with the contracts finally entered into, and also to ensure correct operational procedures.

The applicant expressly authorises MoraBanc to send him/her commercial and promotional communications for products and services and information on the Bank itself, social or other activities, in hardcopy by post or by electronic means (among others, short messages (SMS) to mobile phones, e-mail, etc.). This consent can always be withdrawn, without retroactive effect.

The fact of filling out this form implies that the applicant acknowledges that the information and personal data provided are true, accurate and correct; otherwise, MoraBanc declines all responsibility for the lack of truthfulness or correctness of the data.

The applicant authorises the data provided to be communicated or shared with third parties forming part of the MoraBanc business group, entities which are primarily active in the financial, insurance and service sectors. The applicant is considered as having been informed of this transfer of information by means of this clause. The applicant accepts that he/she may be sent information on any product or service marketed by these companies.

The data processing manager is MoraBanc. The applicant is hereby informed that the rights of access, rectification, suppression or opposition may be exercised in the terms established in current legislation.

Or call us at +376 88 48 84