Innovation and co-creation at MoraBanc

Experts | 10.23.2017

Innovation is the biggest challenge for most companies in today’s highly competitive world.

We are living in a Digital Age in which the rise of the collaborative economy provides new ways of doing business and relating with others through the exchange of goods, services, and even knowledge.

This new type of relationship is based on collaboration and trust, and impacts on how companies engage their clients in their processes of continuous innovation and improvement.

It is here that the term “co-creation” appears as a growing practice applicable to various areas of the company as a collaborative exercise through which brands work hand-in-hand with their customers or users to develop communication and marketing strategies, design new products and processes, and even create unique brand experiences.

Empowering the customers’ creative thinking leads to the generation of innovative ideas. Ideas that are aligned with the company’s needs and requirements and which translate not only into better marketing strategies and increased sales, but also to greater customer satisfaction.

What is co-creation?

We can define co-creation as the creation of cooperative experiences and dialogue with groups of customers or potential customers that allow the company to better understand how the users perceive its products and services while allowing the customer to become involved actively in the definition and value proposition of the company.

According to Philip Kotler, in his book Marketing 4.0: Moving from Traditional to Digital, “co-creation is the new product development strategy. Through co-creation and involving the customers early in conceptualization, companies can improve the success rate of new product development. Co-creation also allows customers to customize and personalize products and services, thereby creating superior value propositions”.

At MoraBanc we understand that this is one of the main ways to ensure ongoing innovation and improvement. We are developing co-creation projects with customers as part of the MoraBanc Digital initiative, which will allow us to improve the customer’s all-round experience and offer relevant and personalized products and services for every situation, anytime, anywhere.

MoraBanc Digital and co-creation

The entire MoraBanc Digital project, from the creation of the new public website to the conceptualization and design of the new Online Banking and mobile banking apps for iOS and Android, has been co-created with all the bank’s stakeholders (customers, suppliers, employees and shareholders).

Innovative interfaces and the operational processes of online and mobile banking were designed after listening to what customers had to say and in collaboration with leading companies who have successful implemented the digital experience for financial institutions and e-commerce companies: Fjord, Be Republic, Accenture Digital, Inycom o Web Financial Group.

Example of co-creation

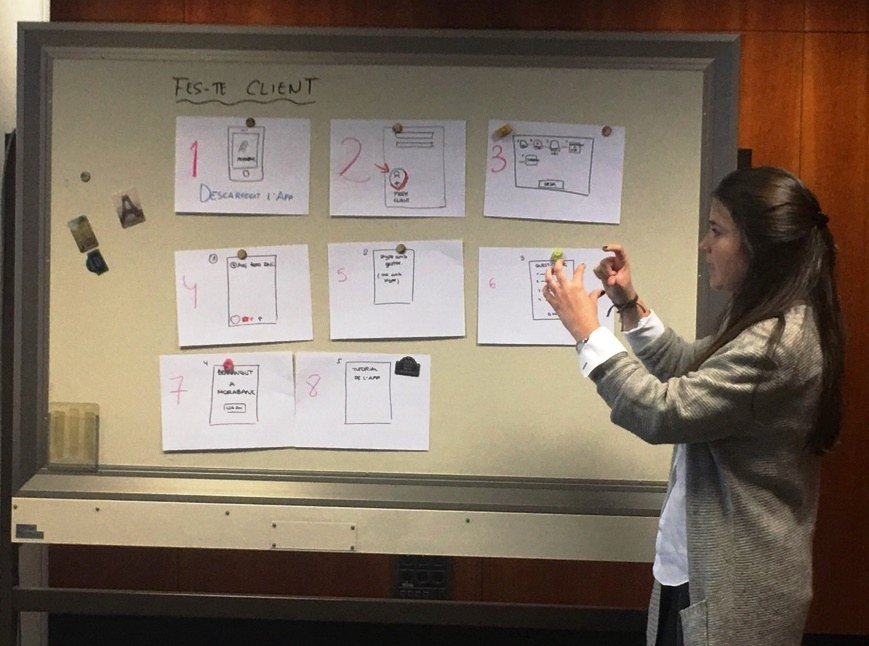

At MoraBanc Digital we hold co-creation meetings and workshops with clients to conceptualize and develop new functions and/or improve existing capabilities in our online banking and mobile banking applications.

In our most recent workshop we analyzed our app with a young audience –18 to 26 year olds– to better understand their perception of the user experience in a product that is doing well and experiencing significant growth in terms of users.

Different areas of collaboration were addressed, from design and usability (UX – User Experience), to the customer experience (CX), to functions that could be implemented in the future.

We are determined to innovate because companies cannot rest on their laurels in a digital world, even if a product or service is successful.

You can see some of the moments from this latest workshop in the photos.

Would you like to participate in future co-creation sessions for our digital services? Send an e-mail to digitalbanking@morabanc.ad. We would be delighted if you helped us innovate!

And if you’re interested in learning about the improvements that we are continually integrating with MoraBanc Digital, keep reading our blog posts or subscribe through the form that you will find at the bottom of this page. And remember, if you have any questions or need help using online banking or the mobile app, don’t hesitate to contact our TeleBanc customer service at +376 884 884 from Monday to Friday from 8:45 a.m. to 5:45 p.m.

Information on the processing of personal data

In compliance with Law 15/2003 of 18 December on protection of personal data, the customer authorizes that the applicant’s personal data entered on this form will be incorporated into files owned and managed by MORA BANC GRUP, SA – MORA BANC, SAU (hereafter referred to as “MoraBanc”) to process the requested service and, if necessary, to comply with the contracts finally entered into, and also to ensure correct operational procedures.

The applicant expressly authorises MoraBanc to send him/her commercial and promotional communications for products and services and information on the Bank itself, social or other activities, in hardcopy by post or by electronic means (among others, short messages (SMS) to mobile phones, e-mail, etc.). This consent can always be withdrawn, without retroactive effect.

The fact of filling out this form implies that the applicant acknowledges that the information and personal data provided are true, accurate and correct; otherwise, MoraBanc declines all responsibility for the lack of truthfulness or correctness of the data.

The applicant authorises the data provided to be communicated or shared with third parties forming part of the MoraBanc business group, entities which are primarily active in the financial, insurance and service sectors. The applicant is considered as having been informed of this transfer of information by means of this clause. The applicant accepts that he/she may be sent information on any product or service marketed by these companies.

The data processing manager is MoraBanc. The applicant is hereby informed that the rights of access, rectification, suppression or opposition may be exercised in the terms established in current legislation.